Like me, you have probably read, seen a video, or heard that the pandemic driven economic crisis of 2020 would lead to a massive rise in foreclosures in the housing market in 2021. On the surface it makes sense. The economy was shut down, unemployment skyrocketed, and about 5.8 million households entered into a mortgage forbearance program. As such, a wave of foreclosures must surely follow, right? Not necessarily! Truth is I can’t say for certain, and neither can anyone else, but I can say that none of the data currently available suggests we are going to see anything close to a foreclosure crisis. For context, I am comparing the current situation to what we saw in 2008, 2009, and 2010, which was a foreclosure crisis. Watch the following video or continue reading below to learn more.

Maybe one of the reasons so many have predicted that we are in for a foreclosure crisis is because bad news sells. I mean, we don’t often hear much good news being reported. A headline that read “Everything is going to be ok” probably wouldn’t get much interest.

All joking aside, I’ve been accused on more than one occasion of being too optimistic. Honestly, I have never believed that there is “good news” or “bad news”, just “news.” It’s our interpretation, or response, to that news that makes it good or bad. That being said, could there be headwinds for the housing market and the broader economy? Sure, but what I always try and do is share the data and help provide some insights and interpretation of that data so that people can make the best decision they can for their specific situation.

Below, is a slide that I first shared in September 2020 from Bankrate regarding the likelihood of a flood of new foreclosures;

To clarify, I’m not suggesting that we won’t see any foreclosures as a result of the economic downturn, just that we are unlikely to see a wave as some have suggested. After all, we see foreclosures as part of the real estate market every year in all markets. The following slide shows the number of quarterly foreclosures in the U.S. going back to 1999;

The previous foreclosure crisis is outlined in red and peaked in Q2 2009 with 566,180 foreclosures. If you average all the quarters together going back to 1999 you have a quarterly average of 206,000 foreclosures. Look at where we are in Q2 2020 - 23,900 foreclosures. Yes, the government did impose a foreclosure moratorium in Q2 that prevented new foreclosures, but even if that number increases tenfold it doesn’t reach what would be considered crisis level compared to last time. For more information on the current forbearance/foreclosure numbers see my Real Estate Market Update for November 2020.

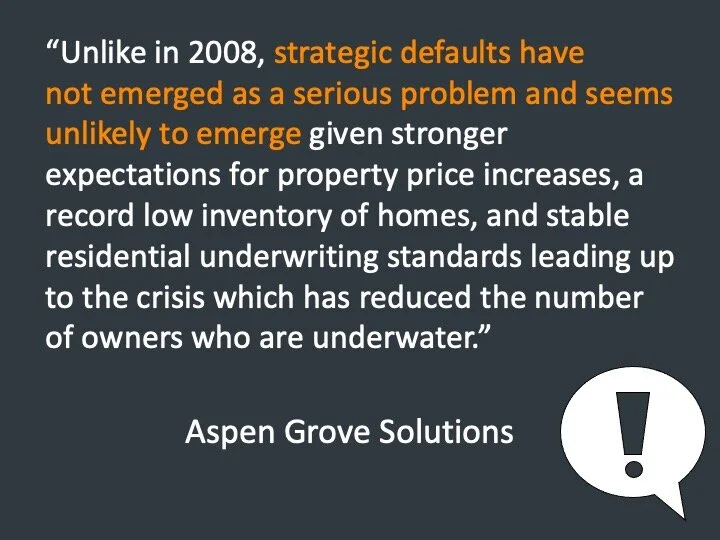

Another reason why we are unlikely to see a foreclosure crisis to the extent we did in 2008 and 2009 is that real estate market conditions are very different today than they were back then. Today, buyer demand is very high while the supply is very low. In 2008 and 2009 we had more speculative demand with high supply. In addition, homeowners today are sitting on a tremendous amount of equity thanks to years of price appreciation. In the previous foreclosure crisis, some of those foreclosures were due to strategic defaults. Defaults that occurred when homeowners could afford to make the mortgage payment but chose not to and walked away. It became a business decision. Why continue to make payments on an underperforming asset on which you owed more than it was worth.

Mortgage standards today are also very different than they were leading up to the previous foreclosure crisis. As you may recall, there were a variety of creative financing options that just don’t exist today. With regard to loans, you have product risk and consumer risk. Product risk exists when the mortgage product itself has an element of risk- low or no down payment, ability to finance up to 125% of the homes value, no income verification etc. Consumer risk is the risk of the actual borrower based on income, credit score, assets etc. There is virtually no product risk in the market today. By reducing the amount of risk in the marketplace you reduce the likelihood of widespread defaults.

What Does This Mean if You’re Planning on Buying or Selling in 2021?

I would expect more of the same. There will be additional foreclosures, but the fundamentals of the housing market continue to remain strong. The New Home Builder Confidence Index was just released and the numbers have hit an all-time high and new housing starts are at their highest level since spring 2007. That means home builders are very confident in the future of the housing market.

But what about the election and the pandemic?

In case you haven’t noticed, even though the election results are not yet finalized, the stock market has been going up, why? It appears as though Republicans are going to gain seats in the House, although Democrats remain in control, and Republicans are expected to retain control of the Senate. It’s also currently predicted that Biden will win the Presidency. So what does this mean? Gridlock! The stock market is banking on the fact that split control of the federal government will lead to more of the same.

As for the pandemic, there is a great deal of uncertainty. As of this writing, the number of positive cases is going up, but the fatality rate as related to total cases is going down as treatments are getting better. It also looks as though a vaccine will be released in the not too distant future. This doesn’t mean we are out of the woods, but when you consider how the housing market has performed over the past 8 months it doesn’t appear as though there will be a major slowdown anytime soon.

As mentioned above, the housing market is experiencing high demand and low supply which supports continued price appreciation. Here is a slide that shows how different housing supply is now compared to the previous foreclosure crisis;

In my local markets of Frisco and Prosper, TX as well as Temecula, CA supply levels are between 1 month and 1.7 months, which are incredibly low. This low supply, coupled with the equity that the vast majority of homeowners have gained over the past years means that anyone truly in trouble and needing to sell could do so, and pay off the existing mortgage, well before the home enters foreclosure.

A Changing Housing Market

What has become apparent over the past 8 months is some aspects of our lives are going to be different as a result of the pandemic. Working from home appears as though it will become more the norm and not the exception. More and more companies are saying they are planning on permanently closing facilities and/or downsizing to smaller facilities. While it remains to be seen what the long-term impacts of this are (commercial real estate is going to be impacted for years to come) what is true now is that many people have realized that their current living environment does not support this new normal. Some people are realizing they need more space while others are looking to move further away from urban areas.

Upwork, a freelancing platform based in Santa Clara, CA, in a recent study found that:

Anywhere from 14 to 23 million Americans are planning to move as a result of remote work.

To put this in perspective, last year roughly 6 million homes were sold in the U.S. This means roughly 2x - 4x as many people are currently considering moving than the total number of current annual home sales. The same study found that 45.3% of the respondents were planning on staying within a 2-hour drive of where they currently live, but 41.5% were planning on moving to a location more than 4 hours away from where they live now.

I recently spoke to an associate who is a real estate broker in Maui. He was telling me that single-family homes are very hard to come by on the island due to the high number of tech people from Silicon Valley who were relocating as a direct result of being able to work remotely.

Bottom Line

2020 has been a year of change, and what you need in a home is no exception. If you have found that your housing needs are changing then let’s connect to explore what options are available to find you a home that fits with your new normal.