You may have noticed, or sensed, that the real estate market is starting to shift a little bit. Almost like one of those hot, still, summer afternoons when you first feel the sense of a slight breeze on your face. If you happened to catch any of the other market reports, or blog posts, I've done over the past couple of months, you'll know this is something we have been talking about and expecting.

The market's obviously been crazy over the past several months and everybody knew it couldn’t continue. It's simply not sustainable. As such, there has been all kinds of speculation about what's going to happen in the months and years ahead. Is the market going to crash? Are we in a bubble that’s going to burst? Is now still a good time to buy or sell? What's happening with all those mortgages that went into forbearance? All sorts of questions that I walk through in this months’ real estate market update. Watch the following video, or continue reading below, to learn more.

As mentioned above, there are signs that the market is starting to slow slightly, and I do mean slightly. Nothing to get overly excited about, but I will say it appears that buyer activity is starting to wane just a little bit. Honestly, I think buyers are just getting tired. It's been a really tough market and many buyers have been left feeling like they just went 10 rounds with Tyson. They’ve been getting beaten up out there. Some buyers have just given up. They're saying, "We don't want to do this anymore. We’re tired and going to take a break." Others are really concerned that the market is overpriced and worried about what’s going to happen in the future.

Ivy Zelman of Zelman & Associates, a well-respected industry analyst, recently said:

The higher the number the higher buyer demand is, so while 86 is still a very strong number the fact that it has declined two months in a row, even if only slightly, is significant.

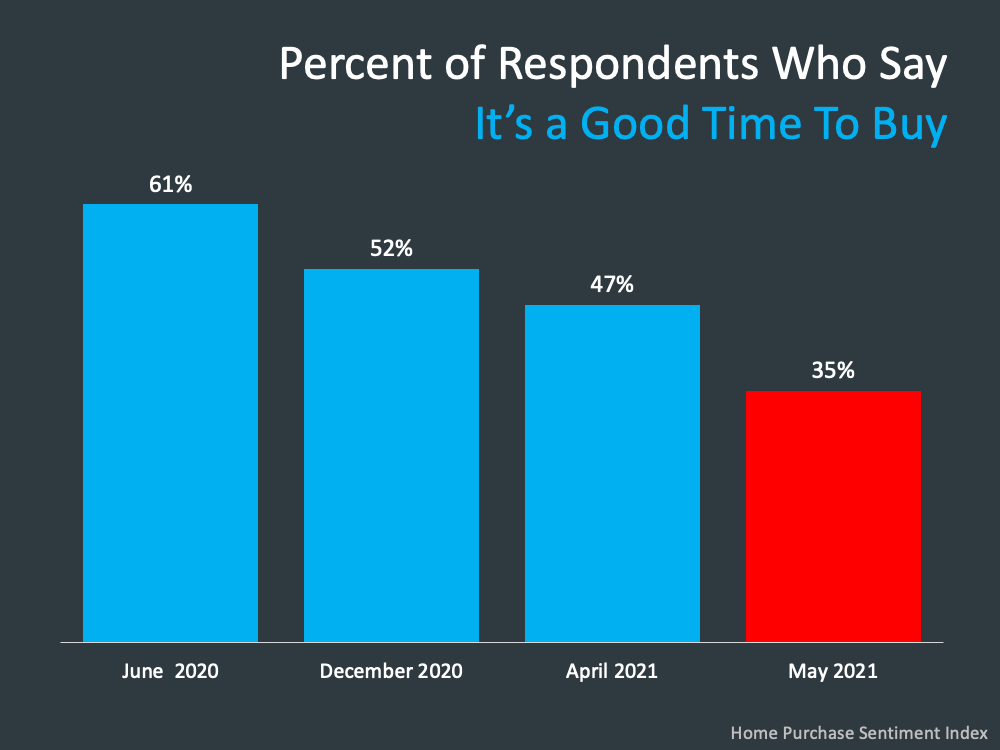

What's more significant is the change in the number of people who think now is a good time to buy. According to the latest Home Purchase Sentiment Index, which asks potential buyers whether they think now is a good time to buy, the year-over-year decline was substantial:

Between June of 2020 and May of 2021, the decline from 61% of people thinking it was a good time to buy to 35% is significant. That's a big change, but understandable considering the headlines we’ve been seeing about a housing bubble and the uncertainty about what the future holds, especially in the face of rapidly rising home prices, which we'll get into shortly.

What the housing market needs currently, in order to bring a sense of normalcy back into the picture, is more inventory. Have you noticed a few more listings popping up in your neighborhood? The good news is we're starting to see more inventory come on the market across the country. Some of this inventory is from sellers who want to take advantage of current home prices, while sellers who delayed selling during the pandemic are starting to feel more comfortable about moving forward with their plans now. Here's the month-over-month change in housing inventory across the country:

While Texas showed a 9.6% increase in inventory month-over-month for the state as a whole, we haven't seen that much here in the Frisco and Prosper markets. Inventory is up, but we are still very constrained at just under a one-month supply.

California is up 8% overall, but in Temecula and Carlsbad, where my team operates, inventory remains at a one-month supply also.

Rising inventory, coupled with a decline in buyer activity will help bring an end to the multiple offers and bidding wars we have been experiencing. I personally believe the slight decline in buyer activity discussed above has more to do with buyer fatigue and the uncertainty about home prices going forward than anything else. The media has been full of headlines about a housing bubble and there is a growing perception the market is overinflated. At some point, the air is going to come out of the market. It has to, right? The real question is will the market cool or will the market correct?

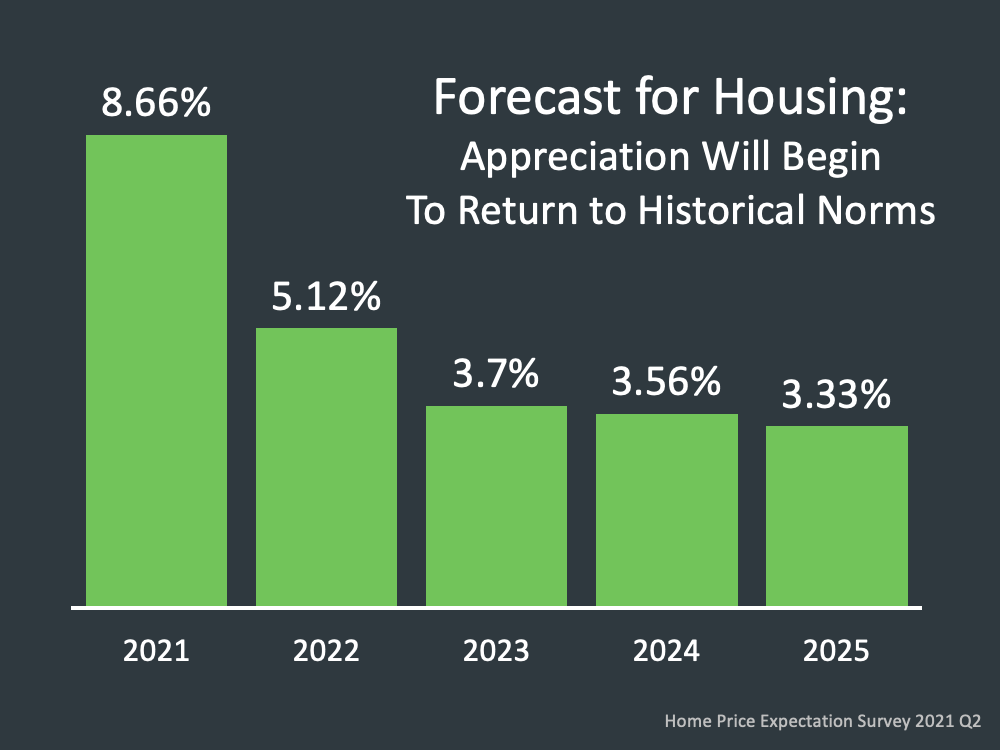

I've talked a lot about a potential bubble over the last couple of months and none of the industry experts, or wealth management companies, think that home prices are going to come down in the near term. As a matter of fact, the recently released home price expectation survey shows that home prices are expected to continue rising for the next several years, albeit at a more reasonable pace:

For anyone that's been thinking of buying, but is waiting for home prices to come down, there's no indication that is going to happen over the next few years. We're just not seeing any evidence of it, none of the major financial institutions are forecasting it, and I’m not forecasting it either.

You may say, "But wait, Andrew, I'm starting to see homes have price reductions." This is true. You have started to see some price reductions, but don't confuse price reductions with the overall market decreasing. With prices going up the way they have been you have a few sellers that were being a little too optimistic. A house in their neighborhood sells and they become convinced they can get more so they list the home even higher, and then another house does the same thing. Buyers are reaching the point where they're not willing to pay any price, for any home, out of desperation. With that in mind, those sellers are not getting the activity they thought they would, days on market creep up, and those sellers start having to make price reductions to get back to where the home should have priced to begin with. Those are the price reductions that you're seeing in the market right now, but those price reductions are not an indication that the overall market is going down.

When looking at appreciation, most of the year-over-year appreciation percentages you see are based on the change in median price, which can a little bit deceptive. CoreLogic puts out a report that actually looks at base pricing across the real estate market, which is a better representation. I'll provide some updates on those numbers in the next couple of weeks. The median price is the midpoint of sales in a given market. You may have noticed that more homes in the upper price range are what have been selling compared to lower-priced homes. This is because there haven't been as many lower-priced homes available. That's pushing the median price up a little bit faster or makes it appear a little bit higher than the actual pricing trend.

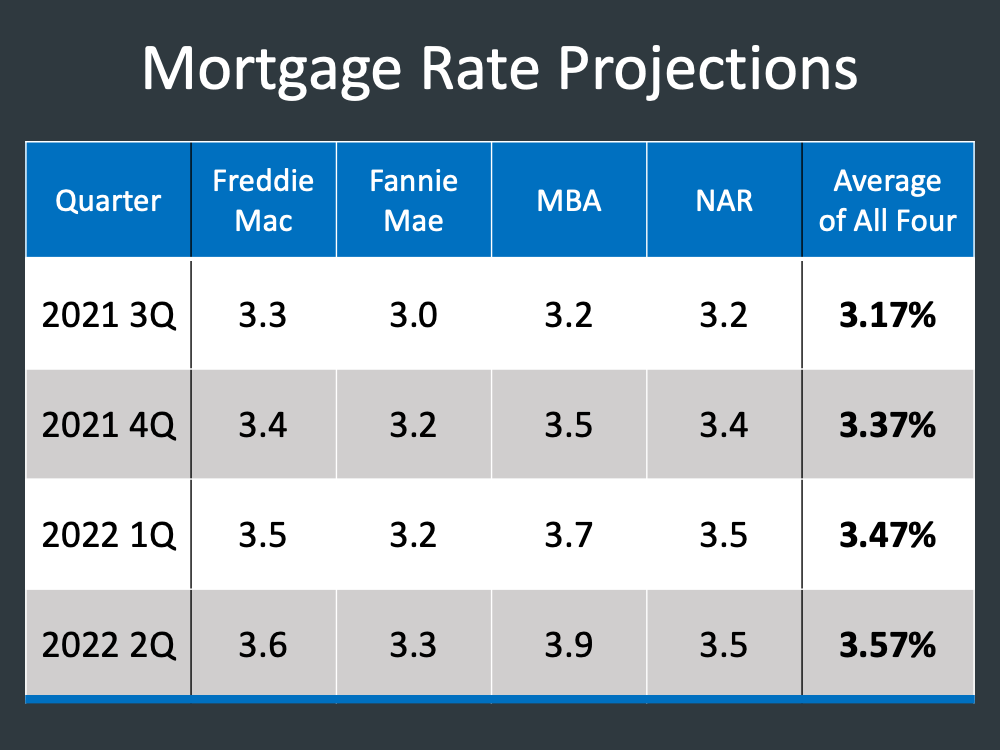

Rising home prices directly impact affordability, but home prices aren’t the only factor when talking about affordability. Mortgage rates play a large role as well and record low mortgage rates have not only been increasing demand but helping keep payments affordable in the face of rising prices. Currently, it looks like mortgage rates are going to continue to gradually rise. Here’s the projection of what will happen to mortgage rates over the next year:

While the projected increase is not tremendous, it is still higher than people have become accustomed to in the era of sub 3% mortgage rates. 3.57% is still a ridiculously great rate by historical standards, but rising mortgage rates coupled with rising home prices will not make homes more affordable going forward. For anyone waiting with the hope that homes are going to get more affordable in the future, I'm not sure that they are, and neither does J.P. Morgan:

While it’s true that homes are not as affordable today as they have been over the past couple of years due to how much prices have risen, they are still extremely affordable from a historical perspective. The following housing affordability index goes back to 1990. The higher the number the more affordable homes are in relation to the amount of income required to make a monthly mortgage payment. Homes are not only more affordable today than they were in 2018, they are actually more affordable than they were at any time between 1990 and 2008:

Rapidly rising prices have caused some to speculate the market is going to turn, then crash, foreclosures are going to appear, and we will see the buying opportunities of 2009 through 2015 appear again. I don’t want to be the bearer of bad news, but the fundamentals of the housing market today are vastly different than they were then and there are no signs that we will see that type of market again.

Harvard University recently released a study, 2021 State of the Nation's Housing, and here's what they had to say:

Again, none of the experts and none of the recently released reports on housing indicate that any sort of crash or bursting bubble is going to happen in the next few years. If there are any markets where we could see a softening of home prices I believe it will be limited to second-home markets that had a large upswing in purchases during the pandemic.

One individual that I follow pretty closely is Bill McBride. Bill has a blog called Calculated Risk that’s really good and he actually predicted the most recent housing crash. He started talking about the risks he saw in the housing market in 2004 and 2005. In comparing the current market to what we experienced in the previous crash here’s what he had to say:

Currently, nobody is saying anything different with regards to the current housing market and what to expect over the next few years. Granted, something unexpected could happen which could change everything like it did with the pandemic, but outside of that the fundamentals of the market are really strong.

We have a supply issue right now more than anything else and that doesn’t appear to be going away anytime soon. But what about all the foreclosures that are coming? What about all of those mortgages that went delinquent because of the pandemic and people losing their jobs?

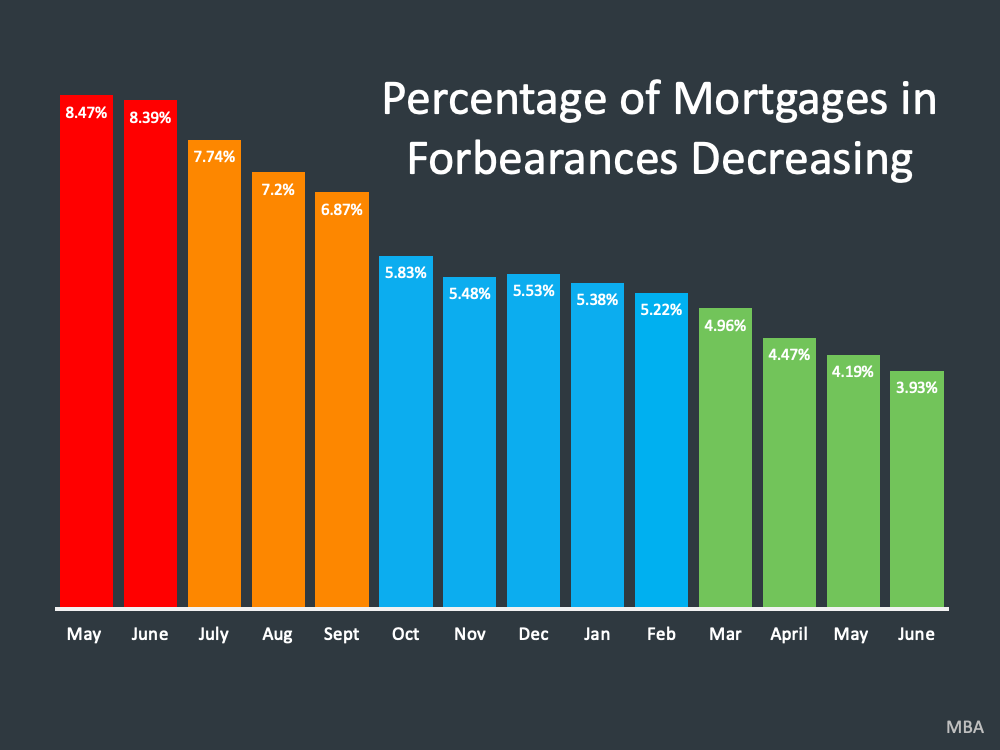

The truth is those are not going to materialize despite all the dire predictions some people made last year. 50% of the mortgages that initially went into forbearance are now out of forbearance without ever actually needing it. It was there as a safety net, so to speak. Here’s the latest update on the number of forbearances:

As you can see, the number of mortgages in forbearance continues to decrease. We are now under 4% of all mortgages at this time. Of those homes still in forbearance, a large number of them, now have at least 10% equity so if they cannot work something out with the bank, could sell and clear all obligations. The idea that a flood of foreclosures, or distressed properties, will be coming to the market, just isn’t true. Those homes that do end up being sold will simply be absorbed without any negative impact on pricing or the overall market.

The decision on whether now is a good time for you to consider buying or selling a home is one that only you can make. I don't present this information to sway you one way or the other, but provide this information so that you can make an informed decision based on facts and not headlines.

if you have additional questions or need clarity on anything that I've covered here today, please feel free to reach out. I'm always happy to talk to you and share whatever additional information I can with you to help you make the best decision for you.