The real estate market has been nothing short of insane the past couple of years. Considering how much home prices have risen, and now that mortgage rates and inflation are on the rise, many would-be home buyers are starting to wonder if it’s time to pump the brakes on plans to buy a home and wondering if renting would be a better option.

If you, or someone you know, has been wondering the same thing then you’re in the right place. In this blog post, I compare the two different options and provide the information you need in order to make the decision that’s best for you.

Watch the following video, or continue reading below, to learn more.

To Rent or Buy?

Considering everyone needs to live somewhere, your choices are to buy or rent, unless you’re living in your parents’ basement, staying with in-laws, or also call your car home!

If you currently rent and skyrocketing home prices and bidding wars weren’t enough to make you nervous, you’re now faced with inflation running at a 40 year high. Everything from gas to food to clothes is more expensive and prices seem to be rising daily. Under the circumstances, while the idea of tying yourself down with a mortgage is frightening, it can actually create long-term stability. Stay with me here and please know that I’m not trying to convince you one way or the other, but simply provide the information you need in order to make the best decision for you and your family.

In times like these, people have a tendency to get tunnel vision. It’s easy to focus on just one part of the equation. My goal is simply to pull back a little to make sure you’re seeing the big picture.

Rents are Rising Rapidly

While plenty of attention has been paid to rising home prices there has been relatively little discussion about rising rents. There’s almost a sense that renting is a safe haven compared to owning, but rising rents have actually made renting more expensive than owning in many areas of the country.

According to the Rent Index from CoreLogic, over the last few months rent has increased at its fastest pace in 16 years. It makes sense because rent prices, just like home prices, are based on supply and demand. Demand for housing is high, supply is low, and people have to live somewhere. I understand that renting might not have been your first choice as there are many that tried to buy, were unsuccessful, and had no choice but to rent.

The bottom line is rising rents, just like rising home prices, are because of the imbalance between supply and demand. Notice all the apartments currently under construction? They aren’t building those to sit empty.

The Impact of Inflation

What many people don’t realize is that In an inflationary economy, like we are experiencing currently, homeownership can actually act as a hedge against inflation.

Nobody wants to buy at the height of the market and the fear that home prices are going to decline in the short term often prevents people from jumping into the market.

One thing to keep in mind, unless you are a fix-and-flip investor, is that real estate should always be viewed as a long-term investment. Ironically, the vast majority of people underestimate how long they will own the home they are about to buy.

For the first years of my life, we moved every 2 to 2.5 years. I’m not exactly sure why, but we did. I later learned that was how my parents lived for years before I was born.

With that in mind, when my wife and I bought our first house I fully expected we would sell and move within 3 years. 9 years later we were still in the same house. Spent 12 years in the next house we owned and have been in my current house for almost 7😀

The most recent studies show the length of time people live in a home is increasing. While 6 to 7 years was the standard when I started in this business, 9 to 11 years is much more common now.

Now that we know you will most likely be living in your home longer than you think, let’s take a look at how home price appreciation has compared to inflation by decade.

The blue bar is the average inflation rate for the decade, while the green bar shows average home price appreciation for the decade.

Home price appreciation has exceeded inflation in every decade except the 80s, when it was fairly level, and the 2000s, when it was just slightly below. Let’s pause on the 2000s for a second though. Remember above I noted real estate should be viewed as a long-term investment? Even in the 2000s, the decade of the biggest real estate crash ever experienced, homes still appreciated overall.

Homes prices have continued to outperform inflation, especially when you look at the last couple of years.

Why is this Important?

A mortgage enables you to fix a large percentage of your housing expenses for 30 years. It becomes a fixed cost. You know exactly how much your housing payment will be for the long term.

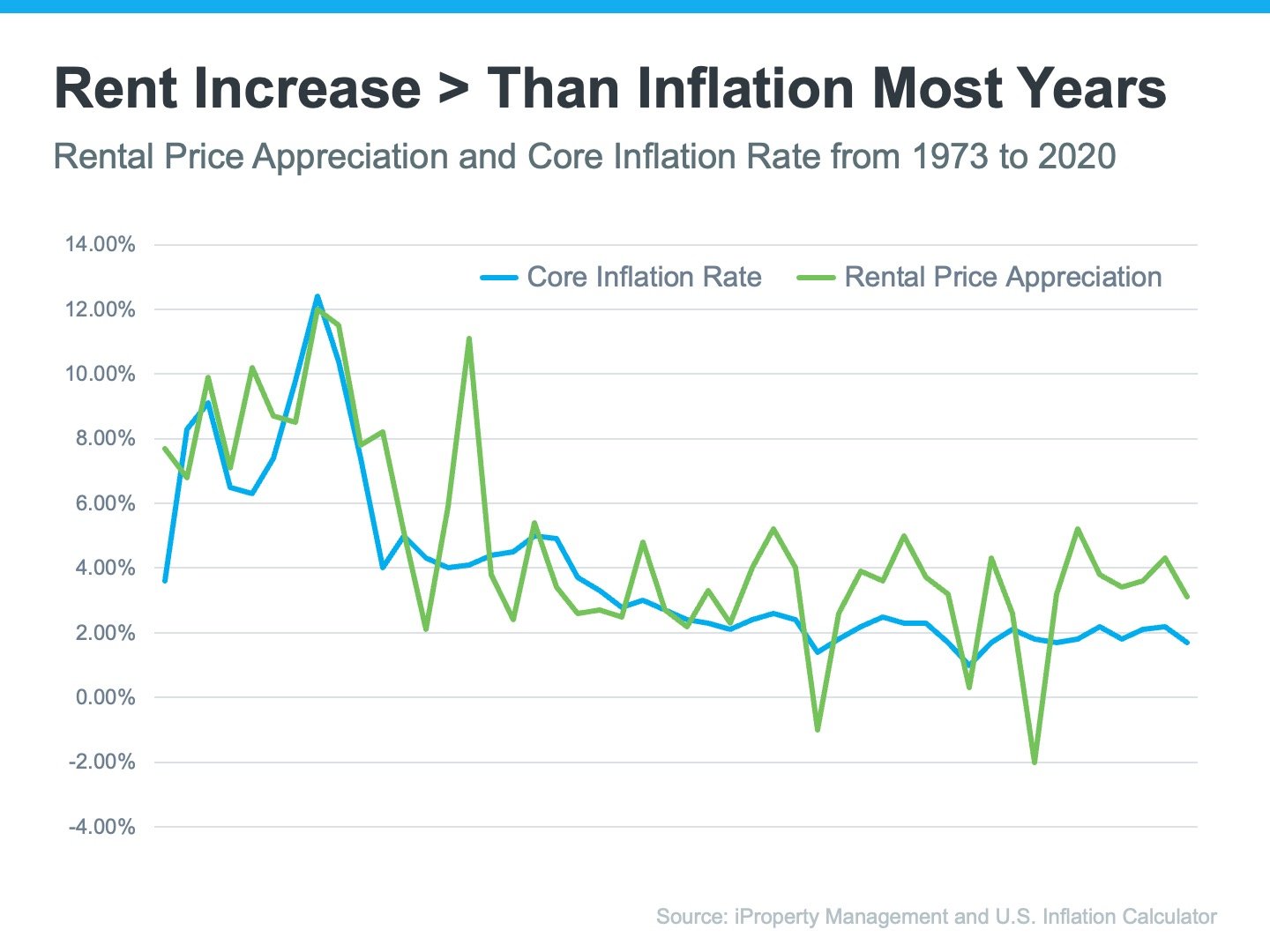

By comparison, here is a look at what rents have done compared to inflation since 1973. Core inflation is represented by the blue line and average rent the green line;

While rent has shown a lot of volatility, it has trended above the rate of inflation for most of the past 50 years.

Unlike a mortgage, your rent is only fixed for the length of your lease.

I understand the move-in costs of buying are higher than renting, and an obstacle for many, but the fact that your rent can change and you might be forced to move every time your lease renews is often overlooked.

Additionally, many would-be homebuyers don’t realize homes can be purchased with as little as a 3% down payment.

For more information on how much money is actually needed to move into a home of your own please schedule a call with me.

Again, my intent in this blog is not to convince you that buying is better than renting. There are a number of situations and circumstances in which renting is absolutely the better solution. My goal is simply to provide you with a different perspective and make sure you know all the facts to make the best decision for you.

I Want to Wait for Home Prices to Fall

I hear this all the time. There has been a lot of information circulating on the internet that a housing crash is imminent. I think much of that information is coming from the same people that 18 months ago predicted we were going to see a flood of foreclosures because of the pandemic……where are they? (hint: they’re not coming)

Rather than promote fear and produce content for clicks, I would rather share all of the newest and most relevant information available so you can make your own informed decision.

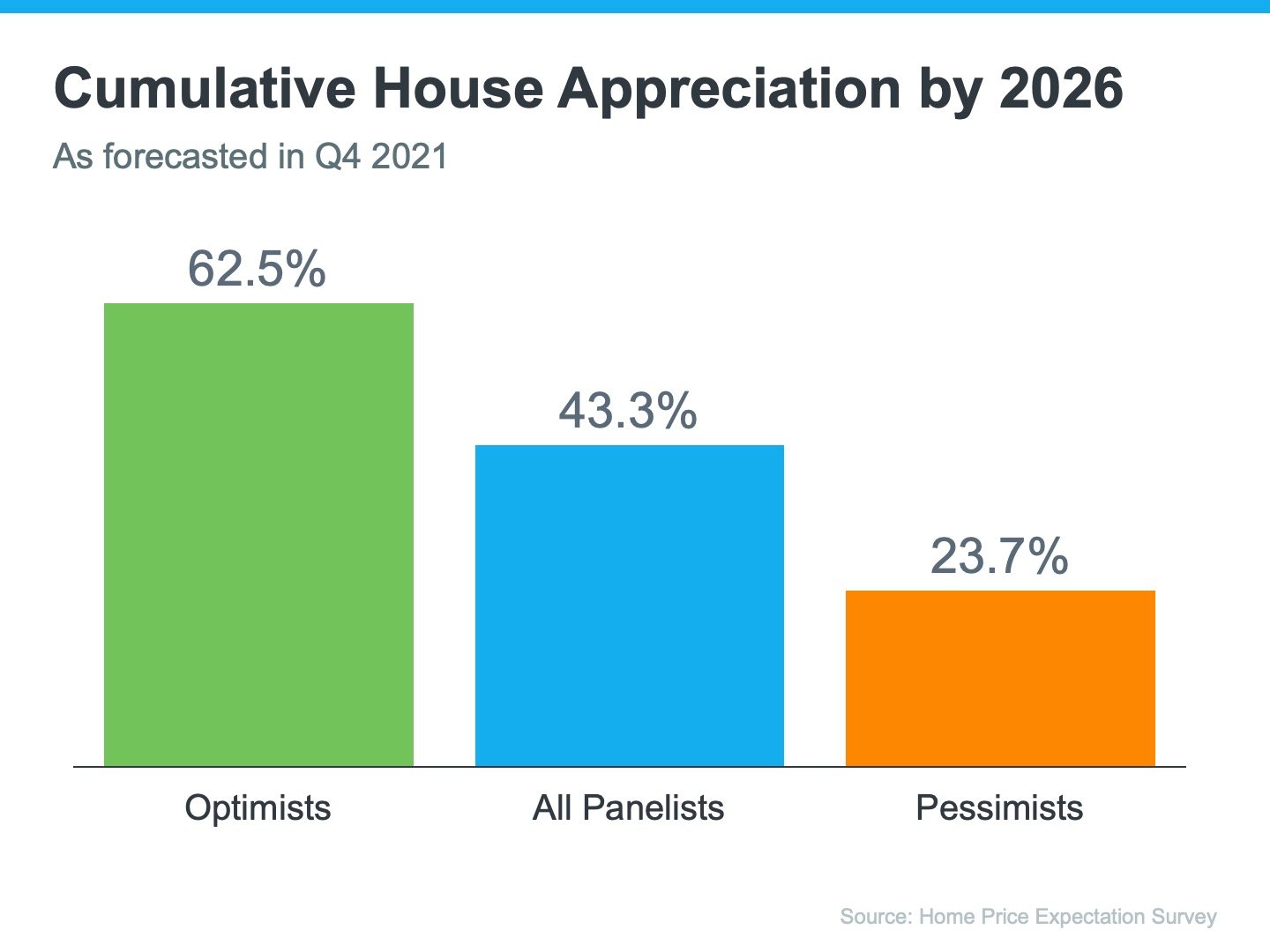

Will the real estate market decline again? Yep, it always goes in cycles. Is that anything to fear and will it be like last time? I don’t think so and none of the leading indicators currently show any sort of slow down is on the horizon. As a matter of fact, the Q4 2021 Home Price Expectation Survey was just released. This survey asks the leading experts and industry analysts what they expect home prices to do over the next 5 years.

Here is what they are currently projecting;

I think when even the pessimists, the glass is half empty folks, are forecasting home prices to rise by nearly 24% over the next 5 years, you can gain confidence that a major correction in the housing market isn’t in the cards based on the information currently available.

Saying that, nobody has a crystal ball and things can change. If they do, stay tuned here or subscribe to my YouTube Channel where I share the most up-to-date and relevant information.

Have additional questions or a situation you’d like to discuss in more detail? Please give us a call at 469-296-5230 or email Contact@S2RealEstateTeam.com