This past week, the median price of homes for sale in the United States hit an all-time high of $404,000.

Surely, home prices can’t keep rising?

Or can they?

Yes, home prices are something I’ve been blogging about quite a lot lately. That’s because questions about home prices and whether or not this is a good time to buy continue to dominate the questions we are asked.

I’ll be honest, it’s a difficult question to answer, not because we don’t have an opinion, but because it can be perceived as self-serving if we’re not careful (we would never put our interests before yours by the way).

Truth is, everyone’s situation is different and the right time to buy, or sell, for one family will be different than another. With that in mind, our goal is simply to provide you with the latest information so you can make the best decision for you and your family based on facts, not fear…..including the fear of missing out!

Watch the following video, or continue reading below, for the latest updates and home price predictions from the experts;

Is it Time to Pump the Brakes?

Over the last couple of years, I’ve read multiple reports and watched countless videos about the housing market. These reports and videos have been from other agents, economic think tanks, real estate experts, etc.

After watching all these videos and reading the reports, one thing I know for sure is that everyone’s crystal ball is a bit foggy🤔

Two years ago, as pandemic-related lockdowns took effect and the economy went into a freefall, I can’t tell you how many videos and reports I saw predicting the housing market was about to crash worse than in 2008.

How did those predictions work out?

I only bring that up to reiterate that nobody knows what the future holds. I do know back then that nobody predicted the pandemic would cause the housing market to take off as it did.

Information and events change quickly, which is why we bring these updates to you as soon as they become available so you can make decisions based on the latest data.

One thing I do know for sure is that every market is different and changes in the housing market will impact some areas more than others. One of the best ways to track market conditions in the city or zip code most important to you is through our weekly market reports.

These reports allow you to see trends and changes in your local real estate market long before the changes make national news.

The link below will take you to the latest market report for Frisco, TX. At the top of that report is a search box where you can see the latest report for any city or zip code in the country.

Frisco TX Market Report

This isn’t 2008

While we firmly believe there will be another downturn in the housing market eventually, it’s important to point out that a repeat of anything like we experienced in 2008 is not on the horizon.

Conditions now are very different to what they were then.

In the years leading up to 2008, there were many things about the real estate market that just didn’t make sense in addition to rising home prices.

Mortgage loans were very easy to obtain in the early 2000s. Not only were people who didn’t really qualify able to obtain a mortgage with little more than a signature and a decent credit score, but homeowners were also refinancing repeatedly and treating their homes like a personal ATM machine.

You could obtain a home equity loan for up to 125% of your home’s actual value and let’s not even talk about being able to make payments that didn’t even cover the interest due on your mortgage each month. No wonder when things went a little sideways everything spiraled down quickly.

Today, homeowners are equity rich. Even if home values were to decline, it would take a decline larger than we experienced in 2008 for the majority of homeowners to be underwater.

Another big difference between now and 2008 is the lack of supply. Inventory wasn’t a problem in the mid-2000s as there were plenty of homes for sale.

Much of the exuberance in the market was centered around new construction homes. While there were lines every time a new phase at a new construction development opened, resale homes weren’t receiving multiple offers, there weren’t bidding wars, and homes weren’t selling within a couple of days of being listed.

There was a tremendous amount of speculation going on with new construction and house flipping was just starting to take off with the masses.

Buyers would sign a contract for a new construction home in the hope of reselling it once completed, before having to make a mortgage payment, at a huge profit.

Again, a very different market where little made sense.

Home Prices

Whilst I know it seems that little makes sense now, we are seeing consistency between the new construction and resale home markets, and unlike in 2008, the primary reason home prices are rising now is the tremendous imbalance between supply and demand.

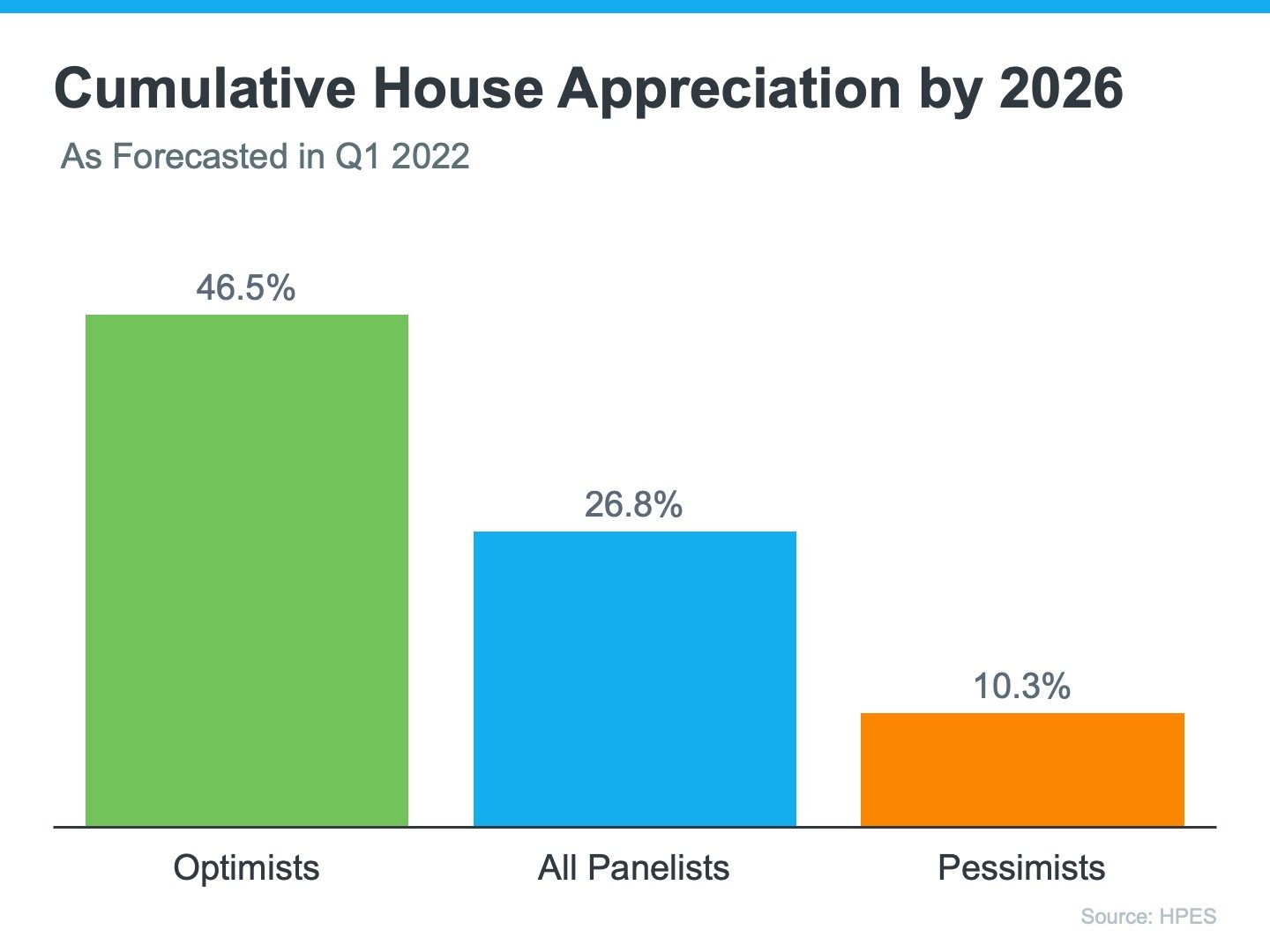

The Home Price Expectation Survey polls 100 leading economists and market experts to gauge what they see going forward. Here is the latest survey from the 1st quarter of 2022 with regard to home price appreciation;

This survey asked these experts where they believed home prices would be in 2026 compared to today.

I think the most telling number on this graph is even the most pessimistic of those surveyed believe home prices are going to increase between now and 2026.

The main reason cited for continued appreciation is the imbalance between supply and demand.

Here’s a look at buyer demand during February 2022 as depicted by the amount of buyer traffic in the market;

Virtually the entire country is showing strong buyer activity.

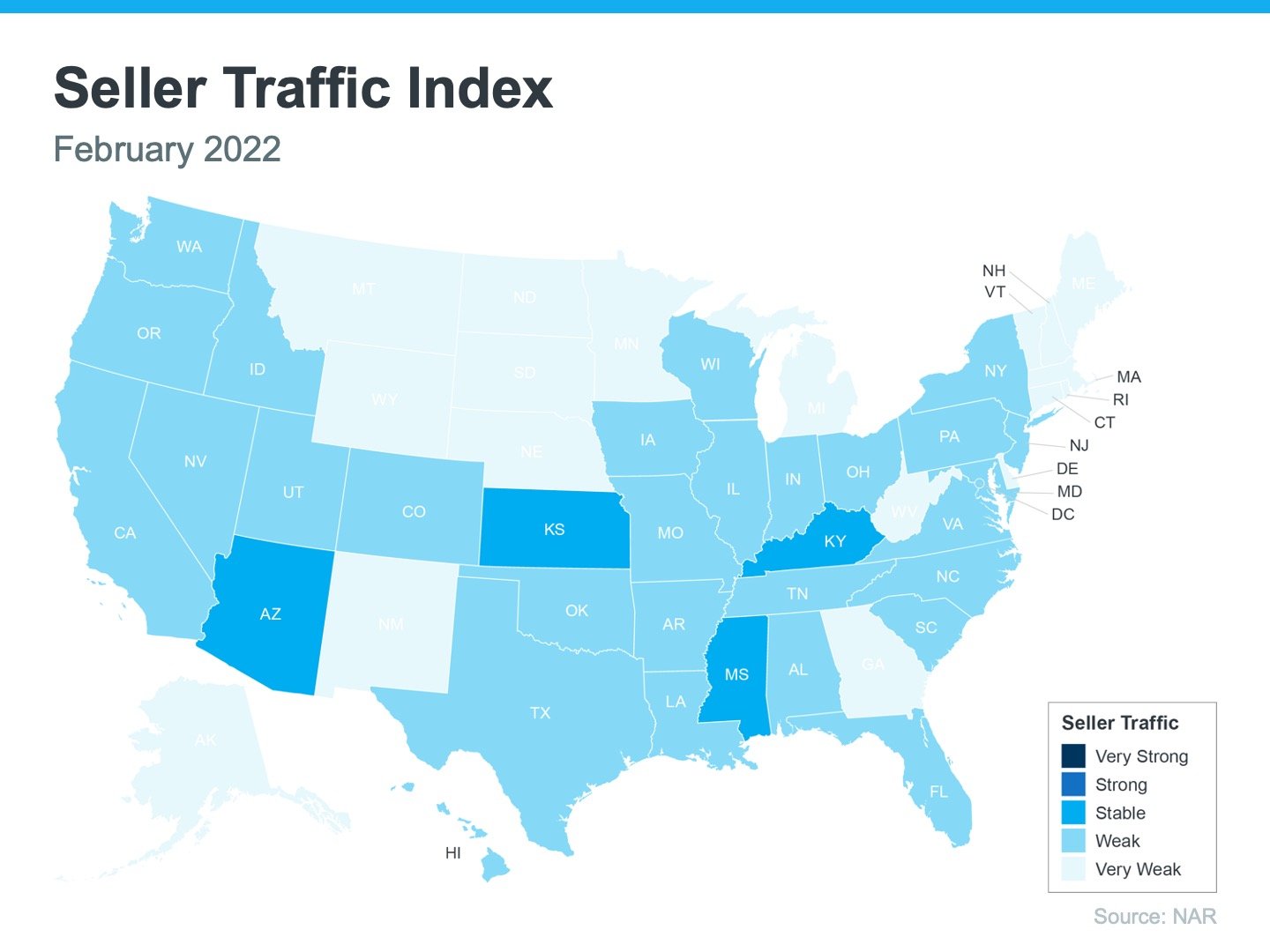

By comparison, here is seller activity depicted by the number of homes for sale, for the same month;

Besides 4 states, the entire country is either in the weak or very weak, category for seller activity.

Granted, these graphs are before mortgage rates jumped in March, but the weekly market report I referenced above is yet to show any signs of weakness in demand in any of the areas that we watch closely.

Bottom Line

It’s not all roses🌹

Do you ever get the feeling, regardless of what the data says, that something is not quite right?

Me too!

While the fundamentals of the housing market remain strong, it’s obvious that prices can’t continue rising as fast as they have been, especially in the face of worldwide economic uncertainty and inflation running rampant.

The Federal Reserve in Dallas released a report this past week saying there were signs the housing market could be approaching bubble territory. To clarify, they didn’t say we were in a bubble but noted over-exuberance and a fear of missing out could lead to a bubble developing.

What they are referring to is the fact rising mortgage rates could cause potential buyers to rush into the market for fear of missing their opportunity to purchase and cause home prices to spike even faster which could lead to pricing conditions outside of market fundamentals.

Click Here to view the story.

At the same time, two other reports this past week talked about why current conditions do not show signs of a housing bubble and why we shouldn’t expect one.

One of those reports was on CNBC and the other was on Forbes.

With all the different information and opinions out there it can be hard to know what to do.

If you have additional questions, or a specific situation you would like to discuss in more detail, please give us a call at 469-296-5230 or email Contact@S2RealEstateTeam.com