Over the past couple of weeks I’ve had conversations with a couple of buyers that expressed concern over the future of home prices. The concern was really a fear. A fear that they could buy a home now and then see prices fall next year. As a real estate agent that’s a tough question to answer. If we tell them we don’t think home prices will fall and they should buy, it can sound self-serving and in our best interest not theirs. If we suggest they hold off to wait and see what happens, and prices go up, we haven’t done that client any favors either. That is why the advise I have always given clients, barring being in the middle of something extraordinary, is to buy when it’s the right time for you to buy rather than trying to time the market. The challenge with that answer is it doesn’t really give an opinion on prices one way or the other!

With that in mind, in this blog post I’m going to share the latest information I have and provide some insights into what I expect home prices to do over the next year. Watch the following video, or continue reading below, to learn more.

2020 has certainly been a year full of challenges. As we enter the home stretch their remains a great deal of uncertainty with a presidential election in the coming week and continued economic uncertainty that could impact home prices in the year ahead.

Unlike when the housing market crashed over a decade ago, the economic rules of supply and demand have been firmly in play and give us the clearest picture of what is to come. Whenever supply of a product is low, and demand is high, prices go up. That is exactly what’s happening in today’s real estate market. The supply has fallen so much that bidding wars have started to emerge once again, which only drive prices higher.

Buyer demand has remained exceptionally high as well. The “new normal” as a result of the pandemic has changed the needs of many families with regard to housing and record low interest rates has continued to keep homes affordable even in the face of rising prices. As a result, experts are projecting that home prices will continues to appreciate nationally over the next twelve months and many have revised their projections upward over the past few months. The lowest appreciation forecast is from CoreLogic at 0.2%, but consider just a few months ago CoreLogic was forecasting at 6.6% decline in home prices over the next year.

What About Foreclosures and Unemployment?

You may have seen the predictions and videos on YouTube saying the housing market is going to crash in 2021. The thought process is that high unemployment and mortgage forbearances will lead to a wave of foreclosures that will cause home prices to drop dramatically. The problem is many of these predictions are based on hypothetical “what if” scenarios.

I’m certainly not trying to paint an overly optimistic picture here, but the current data just doesn’t support that belief. As mentioned above, leading industry experts are all predicting home prices to rise, so what’s the truth? Rather than offer another “what if” scenario I am going to share the facts and data with you so that you can draw your own conclusions.

Unemployment

No one is denying the fact that the unemployment numbers have been staggering. As I’ve mentioned in previous blogs, this recession has been particularly unkind to the service and hospitality sectors. Airline, travel, bars, restaurants etc. have been very hard hit, but when you specifically look at the housing market the vast majority of the workers in those industries tend to be renters and not homeowners or homebuyers. I’m not trying to generalize and suggest all are renters, but a large percentage are. Multi-family homes, apartment complexes etc. are feeling the pressure as many of those people have not been able to pay the rent. I do believe there could be some pain in the future of commercial real estate.

The good news with regards to unemployment is that the total number of continuing unemployment claims continues to drop, which indicates people are returning to work.

Potential Foreclosures

As people head back to work the number of mortgages in active forbearance also continues to declne.

As stated in previous blogs, some of the assumptions made by those forecasting a wave of foreclosures was that the payment deferral of 90 days being offered initially by most lenders wasn’t going to do any good as a lump sum repayment was due at the end of the 90 days. People out of work wouldn’t be able to make that payment so the default process would start. My belief was that was a temporary solution to buy some time to figure out what the best course of action was. This came upon everyone extremely fast and what I did know is that the banks didn’t want a repeat of the previous foreclosure crisis. So far that is exactly what has happened. Here is an updated picture of what has happened to those mortgages that initially entered a forbearance program.

As you can see above, more than half of the mortgages that initially entered forbearance plans have had those forbearance plans extended. 41% are no longer in forbearance as the loan has either been brought current or paid off (I suspect many of those that were paid off were sold), and only 54,000 are actually in the foreclosure process. I know that 54,000 sounds like a lot of foreclosures, but more than 6 million homes are expected to sell this year and approximately 1% of sales in the best of markets are foreclosure sales.

What about the 2.8 million loans that had their forbearance extended? A great question. I expect we will see some of those loans permanently modified, some will be brought current, sold will be sold and others will end up being foreclosed on.

Home equity is the magic bullet here. A couple of weeks ago I wrote a blog about the options provided by home equity, Home equity is something many homeowners didn’t have before the last housing crisis which meant the options for remediating the problem were limited. As Rick Sharga, EVP of RealtyTrac said;

“We’ll certainly see more repossessions by lenders once the foreclosure moratoria have ended, but maybe not as many as people might expect. Given the record amount of homeowner equity it seems likely that many homeowners in financial distress will opt to take advantage of strong demand among homebuyers and sell their property rather than risk losing it to a foreclosure auction.”

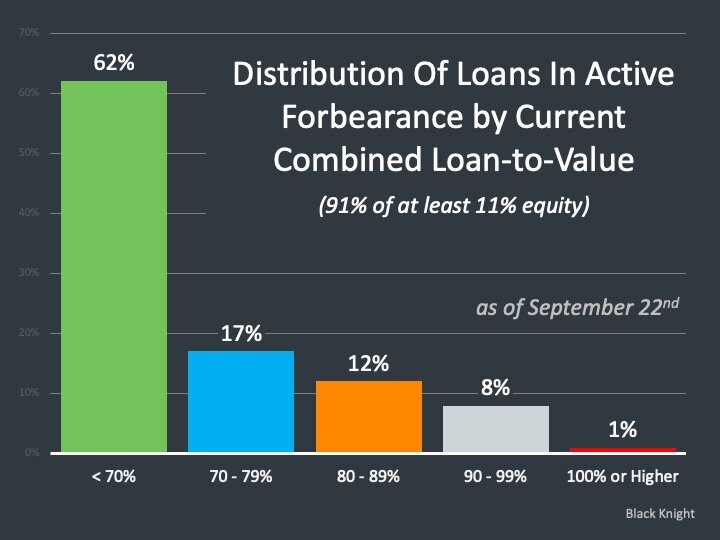

According to Black Knight, 91% of all homes in an active forbearance have at least 11% equity in them which is more than enough to pay off the mortgage and all closing costs in a traditional sale, Only 1% of the homes currently in forbearance have no equity at all and I promise you the lenders would rather those homes be sold as “short sales” than be foreclosed on.

Ivy Zeman, CEO of Zelman & Associates and a highly regarded housing industry expert strongly asserted in her podcast last week:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

Bottom Line

While there is uncertainty about the economic recovery going forward, the economy has recovered from the economic shutdown caused by the pandemic faster than the majority expected. Rather than housing sputtering, it has come roaring back and given record low-interest rates and inventory we are unlikely to see any major changes heading into 2021.