Mortgage rates are on the rise, home prices are showing signs of moderating, but inflation is emerging as a real problem. What does it all mean for our local real estate market?

In this month’s real estate market update I take a look at how home price appreciation has changed over the past few months and do a deeper dive into the market here in Frisco, TX, and in Temecula, CA, where my team also operates. I’ll also talk about the impact rising mortgage rates and inflation are likely to have on home prices going forward. Watch the following video, or continue reading below, to learn more.

Home Prices

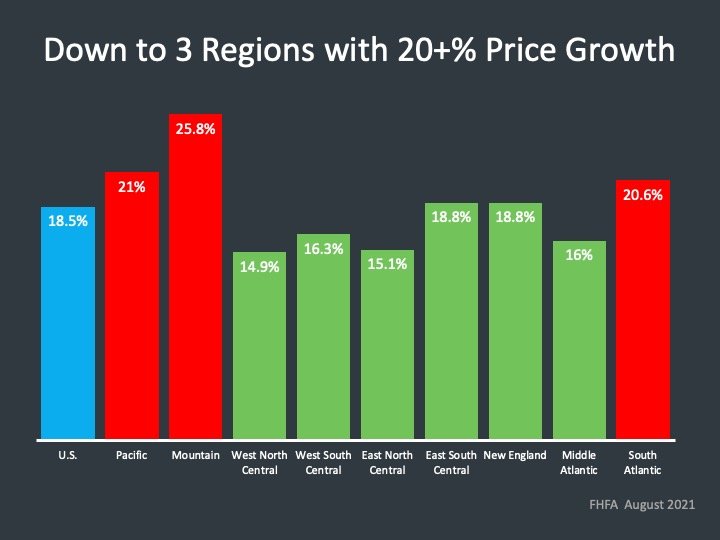

Home prices have been rising at what seemed to be an ever-accelerating rate for much of the year. In fact, until recently, most regions of the country have been seeing year-over-year price appreciation in excess of 20%. Over the past couple of month’s I’ve been talking about signs of a slow down beginning to appear (which is a good thing as home prices cannot continue to appreciate at a pace that’s four times greater than wages) and that is starting to show in the latest data, which lags behind due to the time it takes to compile:

The graph above is showing that as of August 2021, only 3 regions of the country still had price appreciation above the 20% per year pace and the national average had dropped to 18.5%.

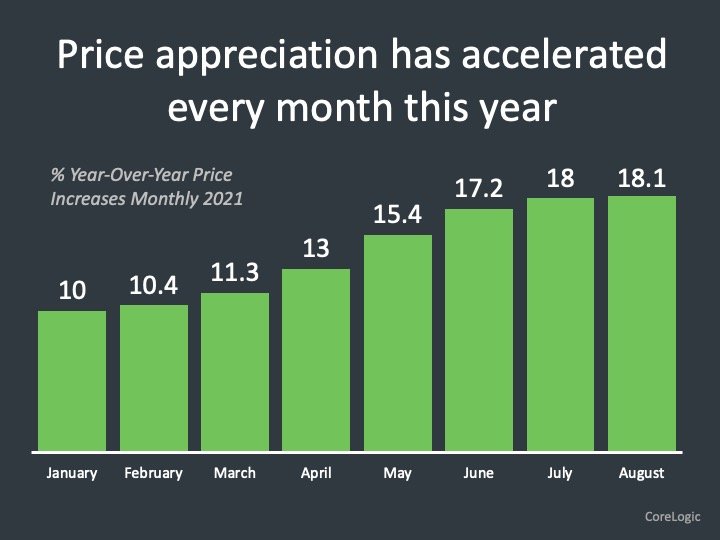

The monthly gains have been slowing for much of the summer as the following graph shows:

You can see that the biggest gains were experienced between March and June, but since then the pace of appreciation has slowed.

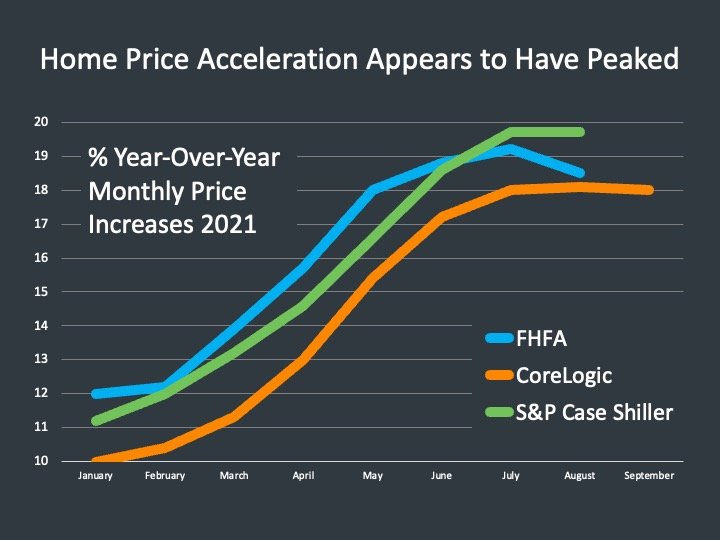

Here is how it looks when you combine the data of the 3 most popular reporting institutions.

All three are showing that the pace of appreciation has started to flatten and FHFA’s data actually shows that the pace is starting to decline.

Please keep in mind this isn’t saying that home prices are declining, but the annual pace of home price appreciation is declining.

Although both Frisco, TX and Temecula, CA are still above 20% annual home price appreciation as of October (Frisco, TX median prices increased 27.3% Y-O-Y and Temecula, CA increased 27.8% Y-O-Y) both markets are also seeing that pace level out and I expect we will see it decline in the months ahead.

Frisco Median Home Prices

Although still increasing, if you look to the far right hand side of this graph, which is showing the median price of new listings in Frisco over the past 3 years, you will see that even though the trajectory is still up, the line is flattening compared to this time last year. Normally, we would see the median price of new listings decline in the 4th quarter due to it being the slowest time of the year for real estate activity.

Here is a snapshot of the current Frisco real estate market as of November 15th.

The Market Action Index is a quick look at the strength of the market in terms of demand relative to supply. It’s like a speedometer. The higher the number is to 100 the faster the market is moving and any reading over 30 indicates market conditions favor sellers. At 78, we are still in a very strong seller’s market.

Two numbers from the Market Profile I want to draw your attention to are the percentage of price decreases and inventory. Normally, approximately 40% of homes receive a price reduction before going under contract. In the past week, only 14% of listings received a price reduction. It’s interesting to note that 15% of listings received a price increase, which is a sign of how strong the local market remains.

Inventory (supply) remains very tight at 133 active listings. For perspective, at this time of the year in 2018, there were just under 900 active listings.

This report is interactive so if you'd like to view more stats and trends please visit the Frisco Market Report Page.

Please note, from the Frisco Market Report Page you can look up any zip code or city in the country.

Temecula Median Home Prices

In Temecula, the pause in home price appreciation is more pronounced. After peaking in March 2021, then declining over the summer, the median price of new listings has now plateaued. This is important because, over the years, I have seen that the Southern CA market is often a pre-curser to what will be experienced in other areas as well.

Temecula is also still in a strong seller’s market with a Market Action Index of 69, which is a slight increase over the prior week. One big difference between the Temecula and Frisco markets is the percentage of price reductions. More than double the number of homes are having their list price decreased before going under contract than what we are seeing in Frisco. This is still below the historical norm but is a sign of a market that is cooling slightly. As the market continues to cool, sellers who priced their homes ahead of the market are having to make price reductions in order to go under contract.

Inventory remains very low at 158 active listings. In 2018 there were just under 500 active listings at this time of the year.

This report is interactive so if you'd like to view more stats and trends please visit the Temecula Market Report Page.

Home Equity

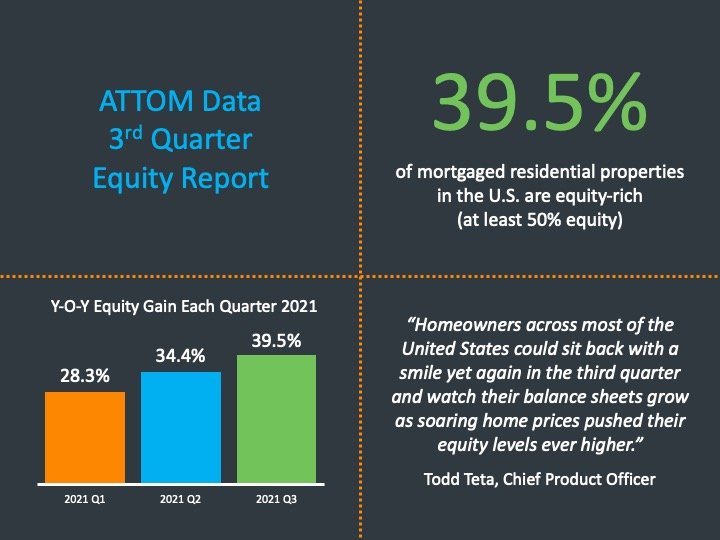

While rapidly rising home prices have created challenges for potential home buyers, homeowners have benefitted from a boost in home equity.

Per ATTOM Data, 39.5% of all mortgaged homes in the country have at least 50% equity as of the 3rd quarter of 2021.

This is very different than what we experienced in 2008 and is one of the reasons we are not going to see a flood of foreclosures now that the mortgage forbearance program has come to an end. There was a tremendous amount of equity stripping that took place prior to 2008. When home values declined many homeowners quickly found themselves underwater leaving them few options.

Foreclosures are a part of every market so don’t be alarmed at headlines talking about a massive year-over-year jump in foreclosure starts. Considering the moratorium was in effect last year and there weren’t any foreclosures, any that happen now will represent an increase in year-over-year numbers but are still way down from a historical perspective.

In many cases, a homeowner that was in forbearance, and has had the missed mortgage payments added to the loan balance, still gained equity over the past year due to the increase in home values.

Mortgage Rates and Inflation

Mortgage rates have been on the rise and although expected to reach 3.5% by this time next year were not expected to have a significant impact on the housing market.

However, we’ve all noticed the price of everything from gasoline to eggs has been rising. The latest numbers confirm that inflation is running at its highest pace in 30 years.

While the Fed has been saying inflation is transitory and being caused by supply chain issues related to the pandemic, many are beginning to believe that inflation is becoming a broader issue.

If the Fed doesn’t see core inflation numbers start to decrease they will have no choice but to raise interest rates sooner than expected. Although the Federal funds rate isn’t directly tied to mortgage rates, mortgage rates will undoubtedly rise based upon what is happening in the overall economy.

Although home prices have continued to rise in times of rising mortgage rates in the past, I do expect that rising rates will put downward pressure on the pace of appreciation and wouldn’t be surprised to see year-over-year home price appreciation rates decline to much more reasonable levels as we move into 2022.

Bottom Line

I share this information, not in an effort to convince you of anything one way or the other but to provide you with the data you need to make the best decision for you and your family.

If you have questions about the market or a situation you’d like to discuss in more detail, please Schedule a Call with me as I’d be happy to talk with you.