There continues to be a lot of chatter about the potential of a housing market crash in the coming year. Some of this chatter is based on speculation, some on opinion, and some is based on nothing but fear.

When I’ve asked people why they believe a housing crash is coming I often hear “what goes up must come down.” While that is often true, when dealing with the price of any good or service there is usually an underlying reason for the decline.

In this week’s blog post I’m going to look at the five main reasons industry crashes occur and see how they relate to today’s housing market. Watch the following video, or continue reading below, to learn more.

The idea that the real estate market is heading for a crash isn’t anything new. We’ve been seeing reports and news stories about the possibility since the pandemic began. The real estate market has been very strong for over a decade now and was continuing to chug along nicely as we entered 2020, then Covid hit!

When the pandemic ground life as we knew it to a halt there was widespread speculation that the housing markets run was over, By the end of 2020, there would be widespread foreclosures and tumbling home values.

The exact opposite occurred and there are currently no indications that a crash is going to happen in the foreseeable future. Industry crashes don’t just happen but are usually the result of specific events. Here’s a look at the five most common reasons industry crashes occur.

5 Main Reasons Industry Crashes Occur

The first reason an industry crash occurs is when the product or service becomes obsolete. As an example think of what happened to Blockbuster when Netflix came along. It wasn’t that Blockbuster did anything wrong, but that business model became obsolete when Netflix offered a better alternative. Ironically, Blockbuster had an opportunity to purchase Netflix but turned it down as they didn’t see the long-term potential. Another example would be the impact Uber had on traditional cab and limo companies.

I think we can all agree that housing hasn’t, and isn’t, becoming obsolete. As a matter of fact, if anything, the pandemic has made housing even more important as it has permanently changed how we define home.

A recent survey by Unison found that 64% of American homeowners believe the pandemic has made their home more important than ever and 91% believe their home makes them more safe and stable.

The second reason industry crashes occur is when demand for the product or service declines dramatically. An example of this would be the impact the pandemic had on restaurants, airlines, and hotels. Those businesses suffered greatly and many didn’t make it as a result of a dramatic decline in demand.

Demand for housing has actually increased over the past year and continues to remain strong.

Bill McBride from Calculated Risk recently noted that even though non-seasonally adjusted demand for housing this past September was down year-over-year, it was one of the strongest September’s since 2005;

As I mentioned in last week’s blog post, the reason we are seeing year-over-year sales declines is that you can’t sell what isn’t for sale. The lack of supply is the only thing that has been holding sales back.

The third reason industry crashes occur is when demand for the product or service is artificially created. We will use real estate as an example here because this is exactly what happened in the early 2000s that led to the previous housing crash. An insatiable appetite to continue originating new mortgage loans led to the creation of exotic loan programs that encouraged people to buy homes they couldn’t afford. Home loans were being made based on credit score alone without the need to provide any verification of income, assets, or ability to repay. A house of cards was created that was unsustainable and eventually came crashing down.

None of those loan programs exist today and lending standards have become substantially more strict. In addition, the overwhelming majority of home buyers today are end-users, not investors or people speculating as we saw just prior to the prior crash.

The fourth reason is when the supply of a product or service increases dramatically. We’ll stick with real estate as our example here. In the years leading up to the crash new home building was at a record high and there were plenty of resale homes on the market.

In 2006 and 2007, nationally, housing inventory was between a 7 and 10 month supply. Prices were continuing to increase due to the artificial demand and there was a frenzy type atmosphere for no reason. Nothing made sense. I know one could argue that nothing has made sense this year either, but the difference is that demand is real and supply remains very low. Nationally, there is less than a 3 month supply of homes for sale and here in Frisco, there is less than a 1 month supply.

What About Forbearance and Foreclosures?

You may recall the headlines from a year ago that talked of a tsunami of foreclosures that would hit as a result of mortgage forbearances. These foreclosures were supposed to dwarf what we saw in the last housing market crash, so where are they?

They’re not coming!

There won’t be a tsunami of foreclosures coming. Yes, it is true that there has been a moratorium in place on foreclosures, but when you look at what has happened to the homes that have already exited the forbearance programs and factor in the equity that the homes still in forbearance have, you’ll see that a large number of distressed homes will not be part of our market going forward.

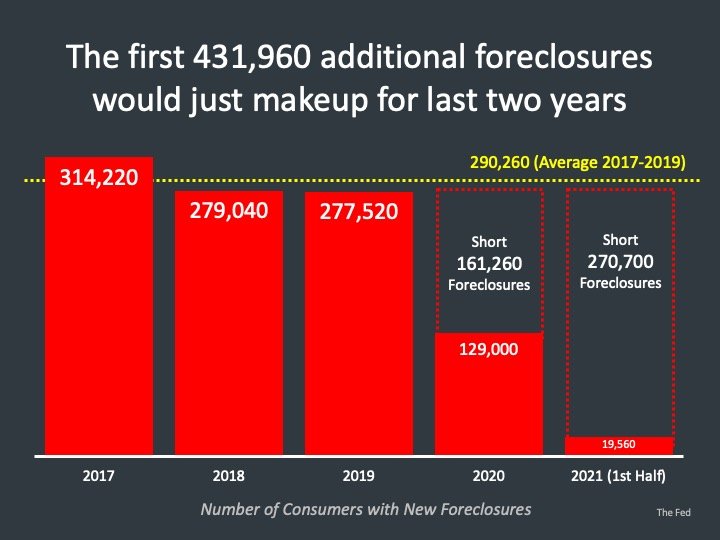

It is important to point out that foreclosures are part of the market every year, they just seldom get reported on. Here is a look at total foreclosure activity over the past four years.

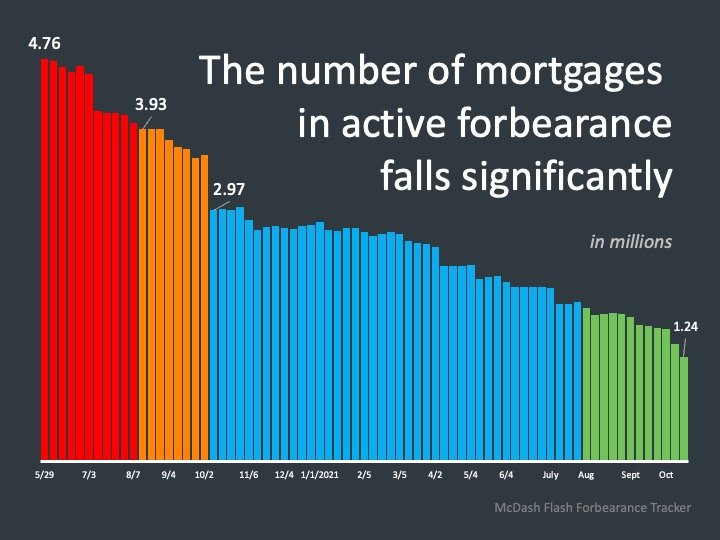

Between 2017 and 2019 we averaged 290,260 foreclosures per year. In 2020 there were only 129,000 foreclosures and in the first half of 2021 there have been 19,560 foreclosures. As mentioned above, moratoriums have been in place that prevented many foreclosures, but here is how the total number of homes in forbearance has changed over the past 18 months;

Currently, of the 4.76 million homes that entered mortgage forbearance, 1.24 million remain in the program. The other homes have successfully exited mortgage forbearance by either bringing their loan current, working out a loan modification with the bank or selling their home.

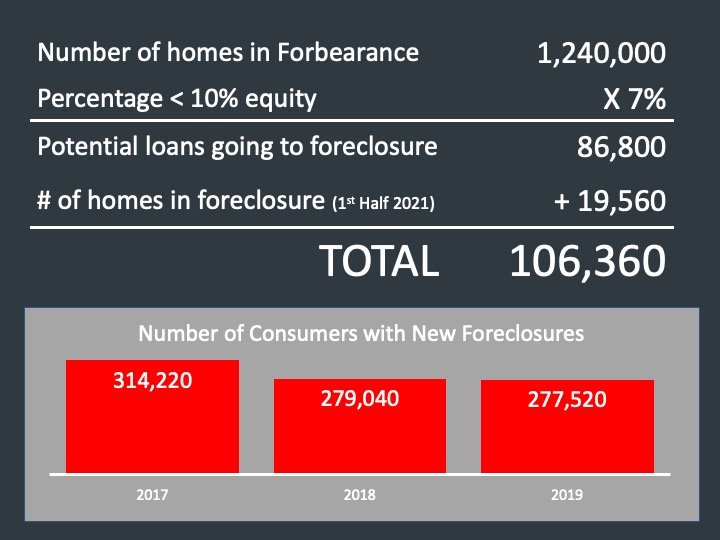

Of the remaining 1.24 million homes still in forbearance here’s how many are in danger of being foreclosed on;

93% of the homes still in mortgage forbearance have more than 10% equity in them currently. The 10% equity is a key number because that is the amount generally considered needed to sell your home traditionally, pay your mortgage balance off, pay all closing costs, and move into a rental property.

The remaining 7% of homes with less than 10% equity represent 86,800 homes. While I don’t wish foreclosure on anybody, if all of those homes were to be foreclosed on this year, even when you add the 19,560 homes that went into foreclosure in the first half of 2021, the total of 106,360 is far fewer foreclosures than we traditionally see in a year and not enough to have any negative impact on the housing market.

The fifth reason industry crashes happen is when demand for a product or service is negatively impacted by an outside market dynamic. A good example of this is what happened to demand for large SUV’s when oil prices skyrocketed a few years ago. Many models were discontinued and automakers made a shift towards building more fuel-efficient models.

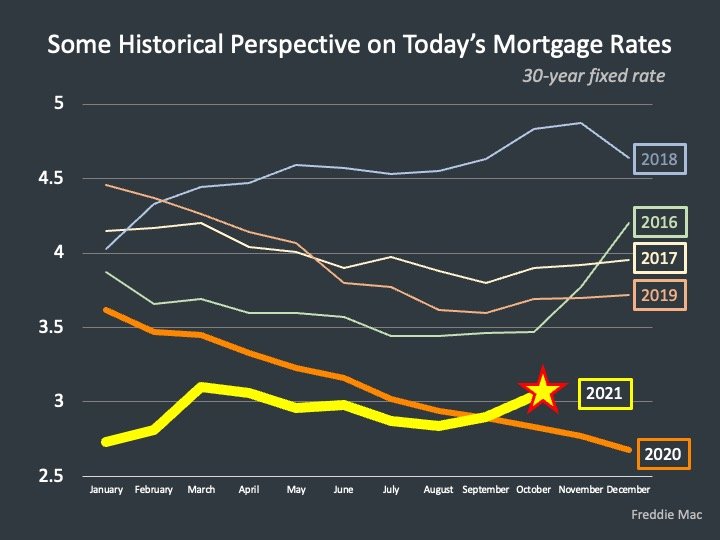

The equivalent for the real estate market is mortgage rates. As mortgage rates fell to historic lows, demand for housing increased. Likewise, as mortgage rates rise high enough then demand will be negatively impacted. It is important to keep some historical perspective though. Currently, mortgage rates are expected to rise to about 3.5% by the middle of 2022.

That is still substantially lower than the mortgage rates we experienced over the last several years as shown on the following graph:

Bottom Line

While these aren’t the only reasons industries can experience a crash, they are the five most common. Much like the pandemic was unforeseen there is always the possibility that something could occur to negatively impact the housing market. I share this information in the hope you are able to make your buying or selling decisions based on facts and not fear.

If you have additional questions or a situation you’d like to discuss in more detail, please schedule a call as I’m always happy to talk with you.