2021 was an absolutely crazy year in the real estate market. We saw record-low mortgage rates, record low inventory, bidding wars, rapidly rising prices, and everything in between. Can we expect more of the same as we enter 2022 or are some changes on the horizon?

In this blog post, I’ll give you a quick overview of how 2021 finished up, share my thoughts on what to expect in 2022 and point out a couple of key indicators to keep an eye on.

Continue reading below, or watch the following video, to learn more.

Overview of 2021

In the winter of 2020/2021, a perfect storm of record-low mortgage rates and low inventory came together. The result was an environment of multiple offers, bidding wars, and rapidly rising prices starting in February here in Frisco, TX.

You might recall, immediately following the initial lockdowns of the pandemic, when everything shut down, speculation of a housing market crash spread like wildfire. Demand for homes would evaporate and a foreclosure crisis larger than 2008 was inevitable. It never happened!. In fact, the exact opposite happened. Starting in June 2020, people’s definition of home changed as home became the office, school. and entertainment venue, the real estate market went crazy. While buyers were out in droves, sellers weren’t quite ready to have potentially virus-infected strangers walking through their homes. Supply was quickly gobbled up by ever-increasing demand and we all know what happened as a result. Talk of a housing market crash was quickly replaced by talk of a housing bubble.

The Frisco housing market started to show signs that a more traditional, seasonal pattern was emerging as we moved into fall, but the market reversed course and started heating up again after Thanksgiving, probably due to fear of rising mortgage rates.

What Does This Mean as we Head into 2022

There are two key data points that we need to keep an eye on as we head into 2022. The first is mortgage rates. The record-low mortgage rates that helped fuel buyer demand also helped to keep homes affordable in the face of rapidly rising prices. As mortgage rates rise, affordability, and therefore demand, is impacted. Then there’s inflation and the impact of rising consumer goods prices. As people are forced to spend more on daily necessities they will have less available for a mortgage. The flip side is that If inflation keeps running between 5% and 6%, a 3.5%, or even 4% mortgage rate can act as a hedge against inflation and help protect wealth.

The second data point we need to keep an eye on is inventory or supply. Basic economics, high demand plus low supply equals increasing prices. That is exactly what we saw in 2021.

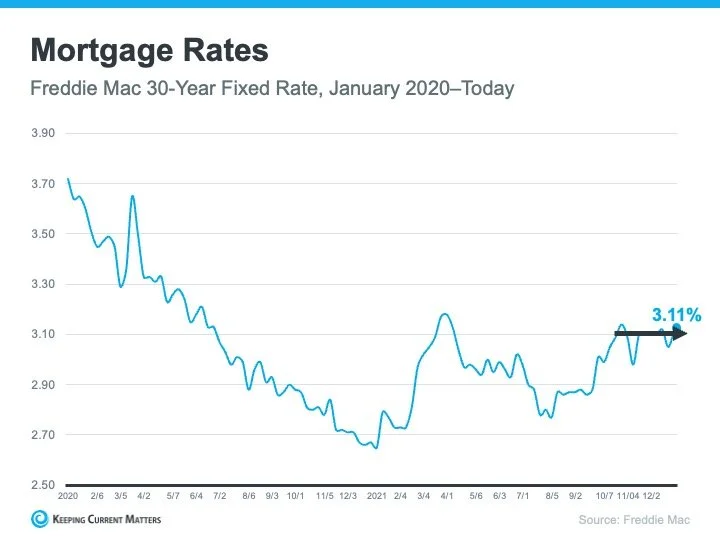

Here’s a look at how mortgage rates have been trending over the past couple of years;

Mortgage rates started climbing at the beginning of the year before peaking in April, which coincided with the height of the market frenzy. After trending downward over the late spring and summer, rates started climbing again in August. Since October, rates have pretty much been moving sideways and held at about 3.11%.

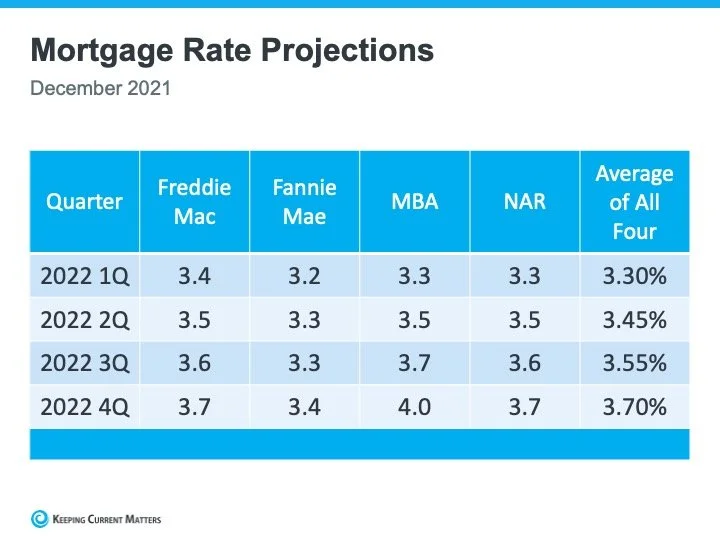

It remains widely expected that mortgage rates will continue to rise throughout 2022. Nothing terribly dramatic, as shown by the latest mortgage rate projections that were just released in December;

Based on these projections it’s reasonable to believe that we should expect to see mortgage rates between 3.5% and 4% in the second half of 2022. While historically still an incredible mortgage rate, it certainly isn’t the 2.65% rate we saw at the beginning of 2021.

Inventory

Inventory, or supply, is the other key data point to keep your eye on. The lack of inventory against increasing demand is what has been driving home price appreciation at such a rapid rate. There are simply not enough homes for sale. Falling inventory is not a new problem, it has been with us for several years now, but has reached a tipping point.

Take a look at this graph from Altos Research that shows the amount of inventory, nationally, we have started each year with going back to 2016;

In January 2016, there were just under 1 million homes for sale nationally. This past week, we set a new record low of just under 300,000 homes for sale. Demand for homes certainly hasn’t gone down, but the homes available to buy certainly has.

We are seeing the exact same trend here in Frisco. Here is a look at how the total number of homes for sale in Frisco at the beginning of the year has changed over the last few years;

In the first week of January 2019 there were 681 homes for sale

In the first week of January 2020 there were 534 homes for sale

In the first week of January 2021 there were 118 homes for sale

In the first week of January 2022 there were 57 homes for sale

Here is the complete Frisco Market Report if you’d like to see it. From that report, you can search the current trends of any zip code, or city, in the country.

Where Will New Inventory Come From

Unlike demand, which can be impacted by a variety of factors, housing supply won’t just appear overnight. New supply comes from new construction or resale homes. New construction supply is coming, more new homes were built in 2021 than any year since 2016, but it will take time to catch up as we have been underbuilt for the past decade.

The resale market has been impacted by a couple of different factors. During the pandemic, many potential sellers kept their homes off the market for health and safety reasons. Now, as many of those potential sellers are starting to feel comfortable enough to put their home on the market they’re finding there’s nothing to buy if they do sell. Not wanting to be left without a home, they feel stuck in a wait-and-see situation. (if that’s you, reach out to us as we have access to a program that allows you to buy a replacement home before selling your existing home.)

The other trend we are seeing is a larger number of existing homeowners choosing to keep their current home and turn it into a rental rather than sell to buy their next home. Traditionally, homeowners have sold their existing home and used the equity as a down payment on their next home. Considering how much home prices have risen over the past few years, and how low mortgage rates have been, an increasing number of homeowners have refinanced and pulled money out of their existing home to use as a down payment while keeping their current home and turning it into a rental. Rents have also risen meaning that the rental payment is enough to cover the new, refinanced, mortgage payment. Great way to build long-term wealth while taking advantage of the historically low mortgage rate environment.

Many were led to believe or hoping, that supply relief would come from a tsunami of new foreclosures due to pandemic-related economic hardships. When the economy shut down nearly 5 million homes entered into a mortgage forbearance program. As of December 2021, less than a million homes remain in forbearance;

So Where are all the Foreclosures?

They’re not coming! Truth is the forbearance programs did exactly what they were supposed to do, keep homeowners out of foreclosure.

Of the 4 million homes that have now exited the forbearance program, 38.6% have either paid the loan off in full or brought their loan current. 44% were able to work out a loan modification or repayment plan. That leaves 17.4% still in trouble. Of those, 0.6% completed a deed-in-lieu or short sale. The remaining 16.8% most likely have enough equity, due to rising home values, that they could sell their home and pay off all obligations in full. (Have much equity have you gained? Click Here to find out instantly)

This isn’t to say there won’t be any foreclosures, there will be, but it certainly won’t be enough to make a big dent in available housing inventory.

Just know, you will start seeing reports in the 1st quarter of 2022 that foreclosures are way up. Don’t be alarmed. Remember, there was a foreclosure moratorium in place last year preventing foreclosures so any foreclosures that happen will appear to be a big jump in the year-over-year numbers.

Home Prices

With demand staying constant and supply continuing to be a challenge, what does that mean for home prices in 2022?

While more new construction inventory is coming to market, and we do expect more sellers to take advantage of equity gains and list their homes in the months ahead, it doesn’t appear as though much is going to change in the first half of 2022, but do expect the pace of home price appreciation to moderate.

We saw signs of this in the second half of 2021, but it wasn’t easily visible due to the year-over-year numbers being reported. Here in Frisco, home price appreciation was exceptionally steep between January and April 2021. Believe it or not, month-over-month appreciation was relatively flat between May and September, although the year-over-year numbers were still high. We saw prices start to appreciate again between September and December as inventory fell and demand unexpectedly increased, most likely due to buyers wanting to buy before mortgage rates went higher.

In December, inventory in Frisco fell to 0.3 months supply. That’s about 3 weeks. Keep in mind that 6 months’ worth of supply is what is required for a housing market to be considered balanced.

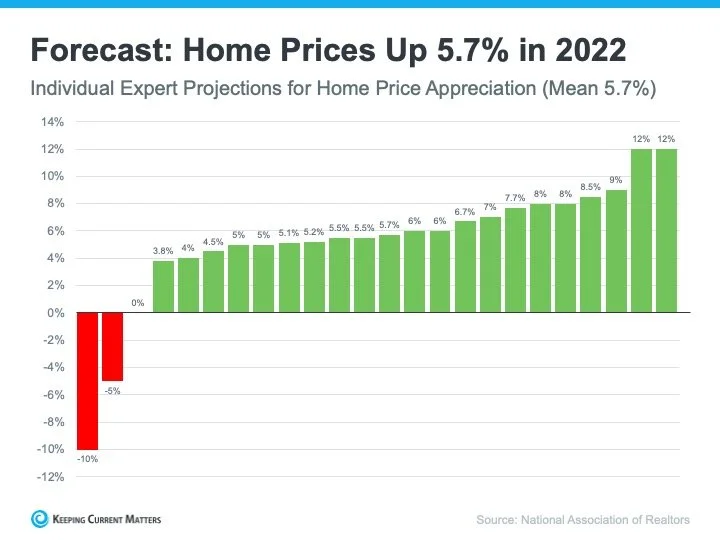

The National Association of Realtors recently surveyed 24 leading real estate economists regarding home prices in 2022 and here are the results of that survey;

Keep in mind these are national projections and not specific to any local market.

Two of the economists believe prices will decrease, one believes they will stay unchanged, and the remaining 21 believe prices will increase. When all are averaged together a projection of 5.7% national appreciation is anticipated.

Locally, I personally believe that we will continue to see price appreciation higher than the national average, but lower than what we experienced this past year. I wouldn’t be surprised if our prices increase another 12% to 16% in 2022.

Here’s what Maiclaire Bolton Smith, Senior Leder of Research at CoreLogic had to say about the 2022 housing market;

Bottom Line

I provide this information not to try and convince you one way or another what the market is going to do. If I knew exactly I wouldn’t be writing this right now, but would be on vacation somewhere😜I share this information in the hope that it provides you with the information and knowledge you need to make the best possible real estate decision for you and your family.

If you have additional questions, or a specific situation you would like to discuss, please don’t hesitate to give us a call at 469-296-5230 or email contact@S2realestateteam.com

Be the first to know whenever we release additional market information by subscribing to our YouTube Channel