The housing market has cooled, home prices are coming down, and sales have slowed. Is this the beginning of a housing market crash or a correction?

Is there a difference between the two?

The headlines seem to do more to confuse than clarify.

If you’re feeling confused by the current housing market you are certainly not alone as several people I’ve spoken to over the past couple of weeks simply don’t know what to do.

Continue reading below, or watch the following video, as I explain the difference between a crash and a correction, and share what the latest data is telling us to expect going forward.

If you are like me, then you’ve probably seen plenty of videos and news stories talking about a housing market crash and comparing the current market to 2008.

First off, this market is nothing like 2008 (I was there), which I’ll talk about more shortly, and second, if we’ve learned anything from the past couple of years it’s that nobody knows what tomorrow will bring.

A couple of years ago nobody predicted a pandemic would shut down the world, or cause the housing market to go on the tear that it did. Likewise, earlier this year nobody predicted mortgage rates would reach 7%.

There are so many variables in play that accurately predicting what will happen next is virtually impossible, but let me share what the data is telling us about where we are and where we a likely heading.

A Crash or a Correction

In the mid-2000s there was a lot about the housing market that didn’t make sense. Prices were rising rapidly despite the fact there was plenty of supply available. Buyer demand was being fueled by exotic loan programs such as negative amortization loans that allowed you to buy with little to no money down and make a mortgage payment that didn’t even cover the monthly interest, let alone any principal, much like a minimum credit card payment, resulting in a mortgage balance that increased every month.

Existing homeowners could refinance their mortgage up to 125% of the homes actual value, essentially treating their home like an ATM machine under the assumption prices would never come down.

It was no surprise the house of cards eventually collapsed and the market crashed.

Over the past couple of years, ultra-low mortgage rates, along with a changing work environment due to the pandemic, increased buyer demand, against what was already limited supply, causing home prices to rise rapidly.

The frenzy that resulted was unsustainable and I don’t think it’s a surprise to anyone that it has come to an end.

Rapidly rising mortgage rates have taken the wind out of buyers’ sails, and sellers have had to adjust by lowering list prices, but that alone doesn’t mean we are heading for another crash.

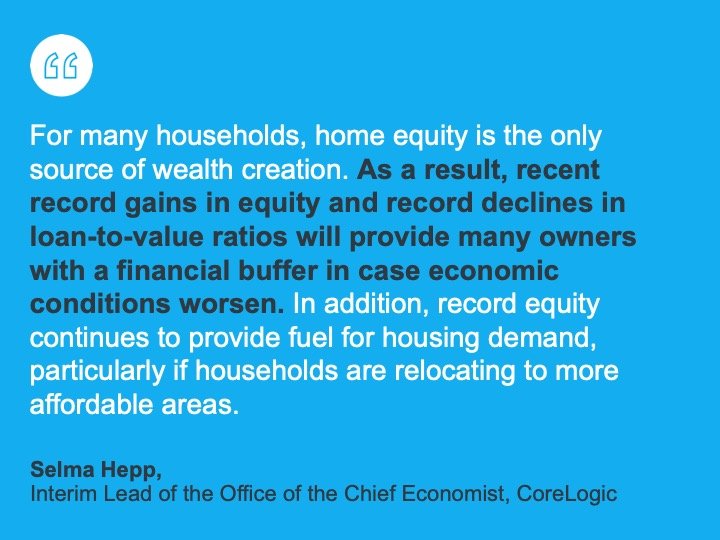

One of the biggest differences now, compared to 2008, is that sellers are sitting on a substantial amount of equity and, even if they did have to sell because of job loss, would most likely be able to sell in a traditional, rather than distressed, manner.

Home prices here in Frisco reached a peak in April 2022. We saw month-over-month price declines through August before recovering a little in September.

Even though home prices have declined, the median sales price in September 2022 was still 20% higher than the median sales price in September 2021.

As we move into the 4th quarter we typically see home prices decline from their highs in the spring due to the normal seasonality of the market.

I expect we will see local home prices continue to moderate, but if you are hoping for prices to roll back to where they were a couple of years ago, there is nothing in the data to suggest that is likely to happen at this point in time.

Home price appreciation is expected to decelerate before settling at between 3% and 5% appreciation annually.

While much of the information you see in media reports, or read online, is discussing the national housing market, all real estate is local. What happens to the market here in the Frisco area will be different than what happens in Los Angeles, Boise, Charlotte, or Miami.

The best way to stay up to date on what is happening in our local market is with my Weekly Market Report. Click the graph below to see the full report for Frisco. From that report, you can subscribe to the weekly update and see the latest date for any city or zip code locally or in the country.

Is Now a Good Time to Buy or Sell a Home?

The answer to that question honestly depends on your current situation and will be different for everyone.

Buyers

If you are currently renting and have a fair rental amount, then now might not be the best time to buy.

Home prices are likely to continue moderating over the coming months, but keep in mind if mortgage rates continue to rise you may not qualify for the type of home you are looking for.

A general rule of thumb is a 1% rise in the mortgage rate will lower your pre-approved purchase amount by 10%.

For example, let’s say you were approved for a $500,000 purchase at a 3.5% mortgage rate. With mortgage rates at 6.5%, assuming everything else remains the same, your approval amount would drop to $350,000.

The 3% rise in mortgage rates caused your buying ability to be reduced by 30%. Since home prices haven’t fallen by 30% over the same period of time affordability continues to decline.

Alternatively, I’ve spoken to several potential buyers over the past couple of weeks who were planning on continuing to rent but found their rent was being increased by $400, $500, or $600 per month and more at lease renewal.

In those situations, you might very well be better off trying to buy.

FHA and VA loans typically offer mortgage rates lower than prevailing conventional loan rates and adjustable rate mortgages, where the initial interest rate is lower but only fixed for a limited period of time, up to 7 years typically, are becoming increasingly popular options.

For anyone interested in new construction, all of the home builders are offering financial incentives to buy right now including money that can be used for a mortgage rate buydown. With a mortgage rate buydown, interest is essentially being prepaid in exchange for a lower fixed mortgage rate.

Sellers

Inventory in our local market is continuing to trend down, which tells me sellers are choosing not to sell at this time. I can’t blame them. The vast majority of current homeowners have fixed-rate mortgages below 3.5%. Why would a homeowner sell a home that has a 3.5% fixed rate loan to buy a new home with a mortgage rate closer to 7%?

The answer is they wouldn’t unless they have to, are paying cash for their next house, or the perfect home for their needs was to come on the market and represent a good value.

In some cases, homeowners will keep their existing home and turn it into a rental while rents are high, or use the equity to buy their dream home knowing they can refinance at a later date when mortgage rates decline.

Bottom Line

There is no right answer for everyone as everyone’s situation is unique and different. If you’d like to discuss the current market in more detail and explore whether now might be a good time for you to consider buying or selling a home, schedule a call. There’s never a cost or obligation and I’d be happy to share the insights and provide the information you need to make the best decision for you and your family.