Just when you think the real estate market can’t get any crazier, it does!

Inflation is running rampant, mortgage rates have jumped substantially, and housing supply has fallen to a new all-time low.

In this real estate market update for February 2022, I break it all down for you and share how each of these factors is likely to impact the housing market going forward.

Watch the following video, or continue reading below, to learn more.

Inflation

It’s hard not to notice the impact inflation is having as prices on everything from bread and milk to gas and gardening supplies are on the rise. This surge in consumer prices has many potential homebuyers wondering if now is a good time to buy a home?

While only you can make the decision on when the right time to buy a home is, shelter is a necessity, and keep in mind rents have been rising even faster than home prices, as discussed in this recent blog post.

While I can understand being nervous about making such a large financial commitment in the face of economic uncertainty, the truth is homeownership actually acts as a hedge against inflation.

Looking back over the past 50 years, here’s how average inflation rates compare to average home price appreciation.

Even in the 2000s, the decade of the worst housing crash ever experienced, home prices still appreciated for the decade overall and were only slightly below average inflation rates.

Over the past couple of years, home prices have exceeded inflation by a substantial amount.

I read a report this past weekend where potential homebuyers were surveyed and the main concern listed in the article was the difficulty in saving 20% for a down payment in the face of rising prices across all goods and services.

A common misconception amongst potential homebuyers is the belief you need 20% for a downpayment when buying a home. While that is often used as a benchmark and required for a standard conventional conforming loan, there are options available that allow you to buy a home with as little as a 3% downpayment.

Mortgage Rates

If rising inflation and rising home prices weren’t enough, mortgage rates have also been on the rise. As a matter of fact, mortgage rates have jumped 0.75% over the past month and are currently sitting at about 4%, which is what the experts believed they would rise to by the end of the year.

The question now is, what impact will rising mortgage rates have on the real estate market overall?

Currently, rising mortgage rates haven’t had much of an impact on the market at all. If anything, rising rates have increased buyer activity and demand as those homebuyers who had been sitting on the sidelines are jumping into the market to try and secure a home before rates move even higher.

While not expected to make a significant impact on the market overall, rising rates will impact affordability and cause some buyers to put their homebuying plans on hold while others might have to start shopping for homes at a lower price point.

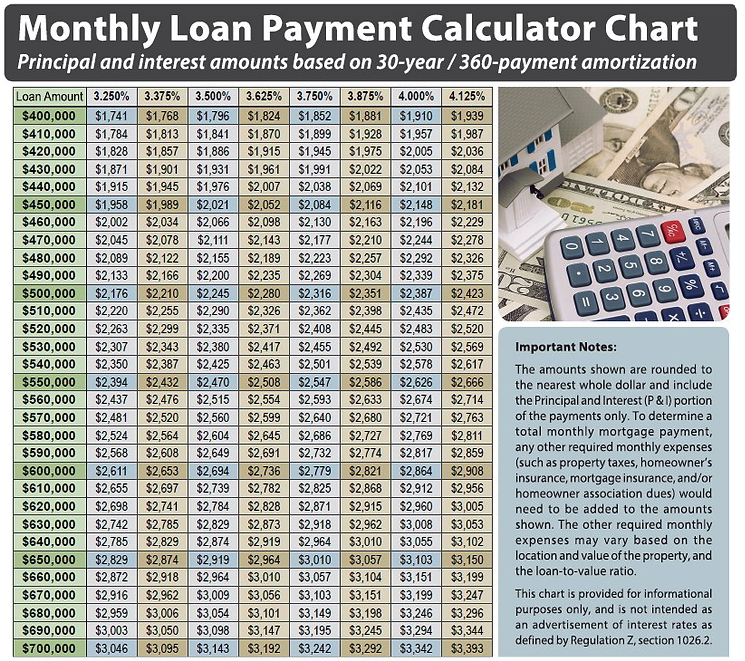

Here’s a chart showing exactly how monthly mortgage payments are impacted by rising mortgage rates.

Let’s look at a $400,000 loan amount as an example.

At a rate of 3.5%, where rates were a few weeks ago, the monthly principal and interest payment would be $1,796 per month. With rates rising to 4%, that payment goes to $1,910 per month, a difference of $114 per month or $1,368 per year.

One more example using a $500,000 loan amount.

At 3.5% the monthly P&I (principal and interest) payment would be $2,245 per month, while at 4% the payment goes to $2,387 per month. That’s a difference of $142 per month or $1,704 per year.

While more expensive, the additional cost isn’t enough to significantly impact the buying decision for most homebuyers and is still advantageous when you consider the amount of equity the home is gaining over the same period of time.

This isn’t to say rising mortgage rates won’t have any impact, they will, and some potential homebuyers will get priced out. As such, we are likely to see a slight decline in overall demand which should help slow the pace of home price appreciation. It won’t be enough to stop it, however, due to the continued imbalance between supply and demand.

Housing Supply

The primary driver of home price appreciation is the continued imbalance between supply and demand. In last week’s blog post I spent time talking about the demand side of the equation, this week the focus is on supply.

While we do expect to see a slight easing of demand, as explained above, we’re not really going to see any sort of balance come back into the market until we see more supply.

Supply can only come from one of two places, new construction or resale homes. While the housing market was oversupplied in the early 2000s, we have been undersupplied ever since.

New home builders, who were crushed by the housing market crash, were slow to react as the housing market recovered.

Here’s a look at how the number of new homes built annually has lagged since the housing market crash;

While the supply of new homes has dropped, demand has increased due to the rising population and more millennial homebuyers entering the market.

Additionally, the supply chain issues that have impacted everything since the pandemic, continue to delay the completion of new homes. New home builders have been facing construction delays of 3 to 6 months as they wait for everything from windows and floor tile to paint and brick.

Many new home communities here in the Frisco area are not expecting to have new homes available until 2023.

Resale Homes

If supply is slow to come from new construction, then we have to rely on resale homes. The challenge here is many current homeowners are reluctant to put their homes on the market as there aren’t any replacement homes to buy. If I sell, where do I go, is a common sentiment.

Foreclosures?

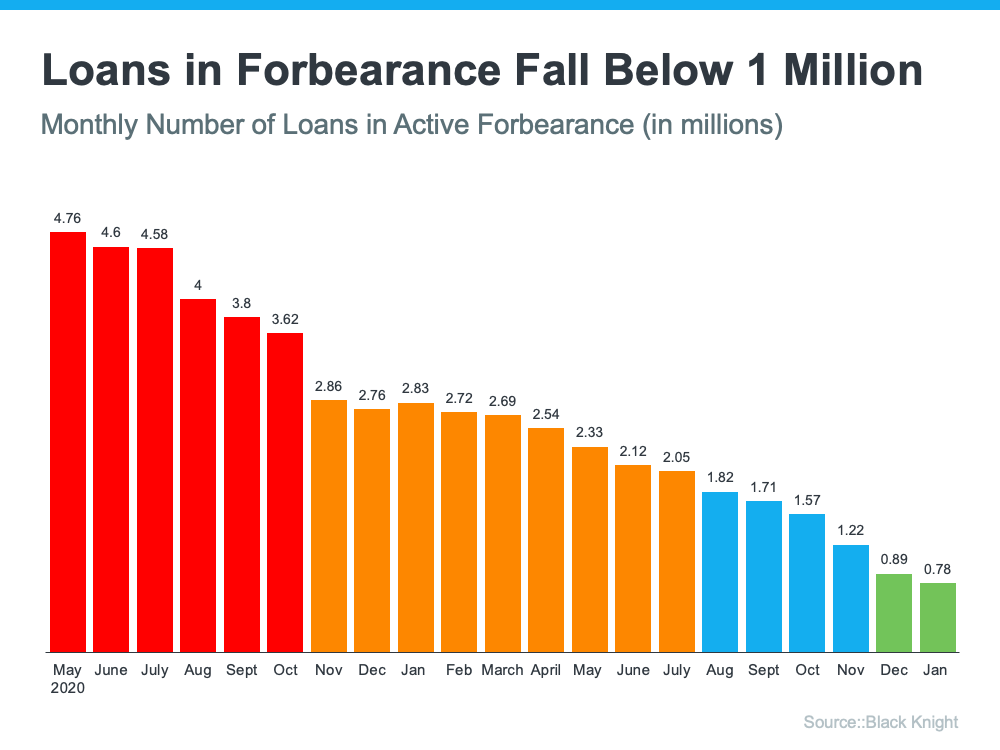

You may recall, at the start of the pandemic, there was a belief the shutdown of the economy would have a devasting effect on the housing market. As more and more homeowners applied to enter forbearance programs a wave of foreclosures was sure to follow. This would result in a housing market crash worse than what we saw in 2008.

So where are they? Where are all the foreclosures?

They aren’t coming!

Thoughts that a wave of foreclosures would ease the housing supply problem are quickly disappearing.

Nearly 5 million homeowners applied for mortgage relief at the beginning of the pandemic. Today, only 783,000 homeowners remain in forbearance programs and that number keeps falling.

Only 11% of the homes that originally entered forbearance plans, remain in those plans.

Since housing inventory remains low across the country, and there are virtually no foreclosures for sale in any of the markets we work in, what happened to those homeowners when they exited forbearance?

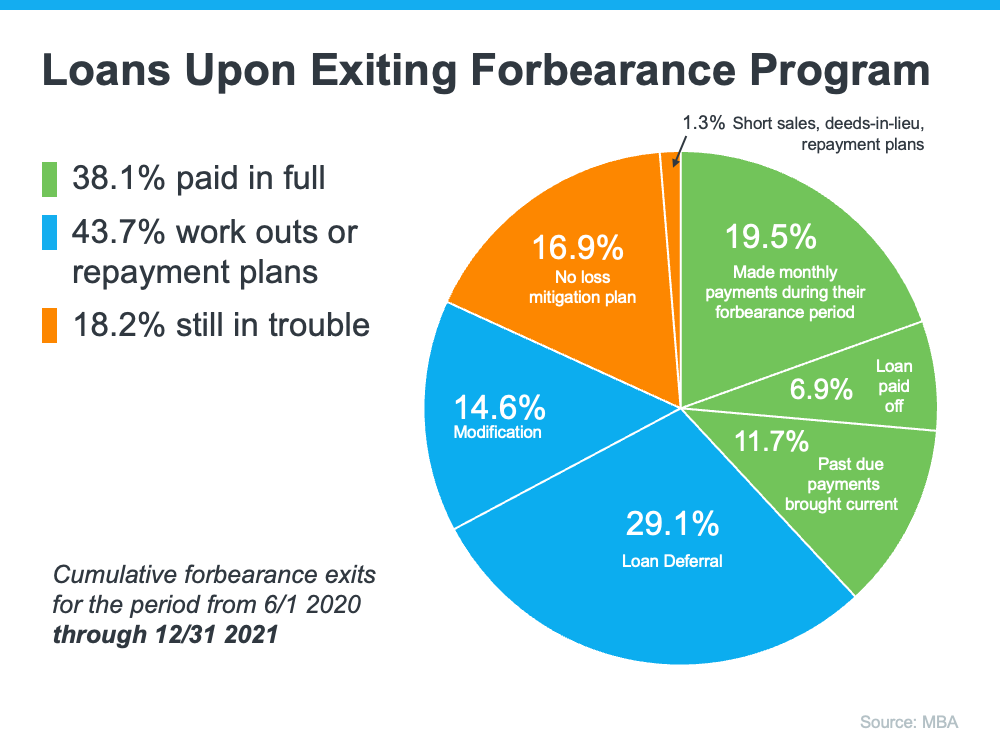

38.1% of homeowners who left the forbearance plan are now current. They either applied for, but never needed, the assistance, brought their loans current or paid the loan off.

An additional 43.7% of homeowners were able to work out a payment plan with their lender.

18.2% remained in trouble with 1.3% of those electing to do a short sale or deed-in-lieu.

Of the 16.9% that remain, Black Knight estimates that 93% of those have at least 10% equity. The 10% equity is a key number because that is widely believed to be the amount of equity needed to sell your home traditionally, pay off the mortgage balance, cover all closing costs, and have enough money remaining to move to another property.

I realize that was a lot of percentages, but the bottom line is if all the homes that remain in trouble, and remain in forbearance, were to be foreclosed on, it isn’t enough homes to make a significant impact on the supply shortfall we are currently experiencing and certainly not enough to cause a housing market crash.

Bottom Line

While I do expect the pace of home price appreciation to moderate, and the rise in mortgage rates to have a slight impact on demand, it appears as though 2022 is going to be another strong year for housing.

While supply constraints should start to ease later in the year, tight inventory conditions and multiple offers are likely to remain in many markets, especially here in North Texas.

If you have additional questions, or a specific situation you would like to discuss in more detail, please schedule a call or send an email to contact@s2realestateteam.com