Home prices have been rising for over a decade and the pace of appreciation reached new heights over the last 2 years.

Is this rise in home prices sustainable or are we setting ourselves up for a crash?

A recent survey of prospective homebuyers revealed that 77% now believe it is NOT a good time to buy a home!

With multiple offers and bidding wars still very much a part of the real estate market not only here in Frisco and Prosper, TX, but around the country, it’s only natural that buyers are getting nervous and questions about a housing bubble persist.

Are we about to see a repeat of what we experienced in the housing market in 2008?

In order to answer that question, we need to know why home prices are rising currently and what the differences are between now and 2008.

Watch the following video, or continue reading below, to learn more.

Why Do Home Prices Keep Rising?

There are so many videos and reports out there about a housing bubble and impending crash that I can understand why people don’t know what to believe. I have a hard time keeping track of it all myself.

As you know, especially if you’ve seen any of my previous blog posts or videos, I share this information not to try and convince you one way or the other, but to provide you with the information you need to make the best decision for you and your family and I want it to be a decision based on facts, not fears.

The overwhelming reason that home prices keep rising is because of the imbalance between supply and demand.

Sorry, that might not be the sexy, overcomplicated reason you were looking for, but it’s true.

Supply and demand control the price of all goods and services in a free-market economy.

What’s Driving Demand?

There have been three main drivers of housing demand over the past few years;

Millennials, the largest demographic, are reaching prime homebuying age resulting in more buyers entering the market

The pandemic changed the definition of home and created a remote work environment that is becoming more permanent than originally imagined. The ability to work from anywhere has changed the migration patterns and allowed communities further from the traditional work hub to grow rapidly. Additionally, with people spending more time at home they are wanting more in their home in terms of rooms and features

Record low mortgage rates made buying a home, or second home, more affordable than ever even in the face of rising home prices

Evidence of strong demand can be found in the increasing number of annual home sales;

It is believed that home sales in 2021 would have been even higher had there been enough homes for people to buy.

Falling Supply

As demand has been growing, supply has been falling. Falling supply isn’t a new problem, but has been happening for years. The challenge now is falling supply reached has collided with growing demand.

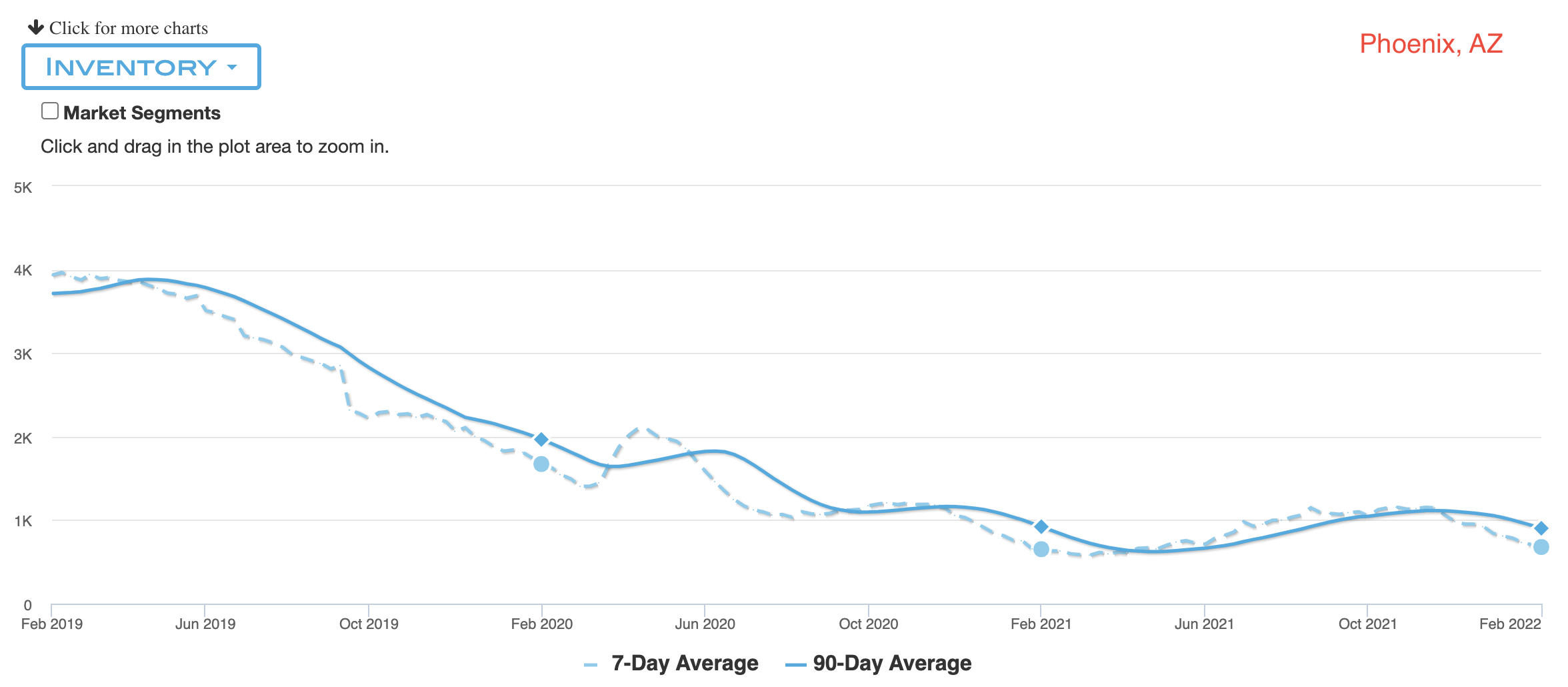

Here’s a look at how the supply of homes has changed in four different cities across the country between February 2019 and February 2022.

Frisco, TX

San Diego, CA

Phoenix, AZ

Baltimore, MD

Although the total number of homes for sale in each of these four markets is different, based on population, the common trait is they have all seen a downward trend in the supply of homes for sale over the past few years.

Click Here to See All Frisco and Prosper Homes For Sale

Isn’t This Just Like 2008?

While it’s true home prices rose rapidly before the housing market crash in 2008 the similarities stop there.

In 2008, everything just felt different and the market wasn’t making any sense given the fact we didn’t have a problem on the supply side. There was plenty of supply while the demand was artificial.

Here’s a look at the national housing supply in the mid-2000s compared to today.

Vastly different!

Keep in mind that 6 months’ worth of supply is considered needed to have a balanced market. Less than 6 months’ supply creates conditions that favor sellers (like we are seeing now to the extreme), and more than 6 months’ supply creates conditions that favor buyers.

What About a Bubble?

A bubble in anything, stock market, housing, etc., usually occurs when external factors, speculation, or over-exuberance continue to fuel demand in the face of increasing supply.

You can see from the graph above that supply wasn’t an issue in the mid-2000s and we didn’t have record-low mortgage rates or millennials entering the market, so what was fueling demand?

The mortgage industry was a major contributor and hundreds of billions of dollars worth of loans were made to people who simply couldn’t afford them. It was the ultimate case of kicking the can down the road. There was an insatiable thirst to fund more and more loans so the qualifications needed to obtain a loan continued to get looser and looser.

Mortgages were essentially based on credit alone with no proof of income or assets needed. The barriers to obtaining a loan were continually lowered.

Take a look at the volume of loans that were made between 2003 and 2007 to borrowers with a credit score lower than 620;

Try and obtain a mortgage with a credit score lower than 620 today and let me know how that works out for you….it won’t.

The house of cards eventually collapsed.

Are We Without Risk?

Absolutely not, but the vast majority of people buying homes today are end-users and there is relatively little investor activity in the market compared to the mid-2000s. Even though Zillow has been working out a deal to sell all of its Zillow Offers inventory of homes to institutional investors, that isn’t enough homes to radically change market conditions.

The foundation of the housing market is strong and very different than where we were in 2007 and 2008. Thankfully, we are already starting to see the pace of appreciation moderate.

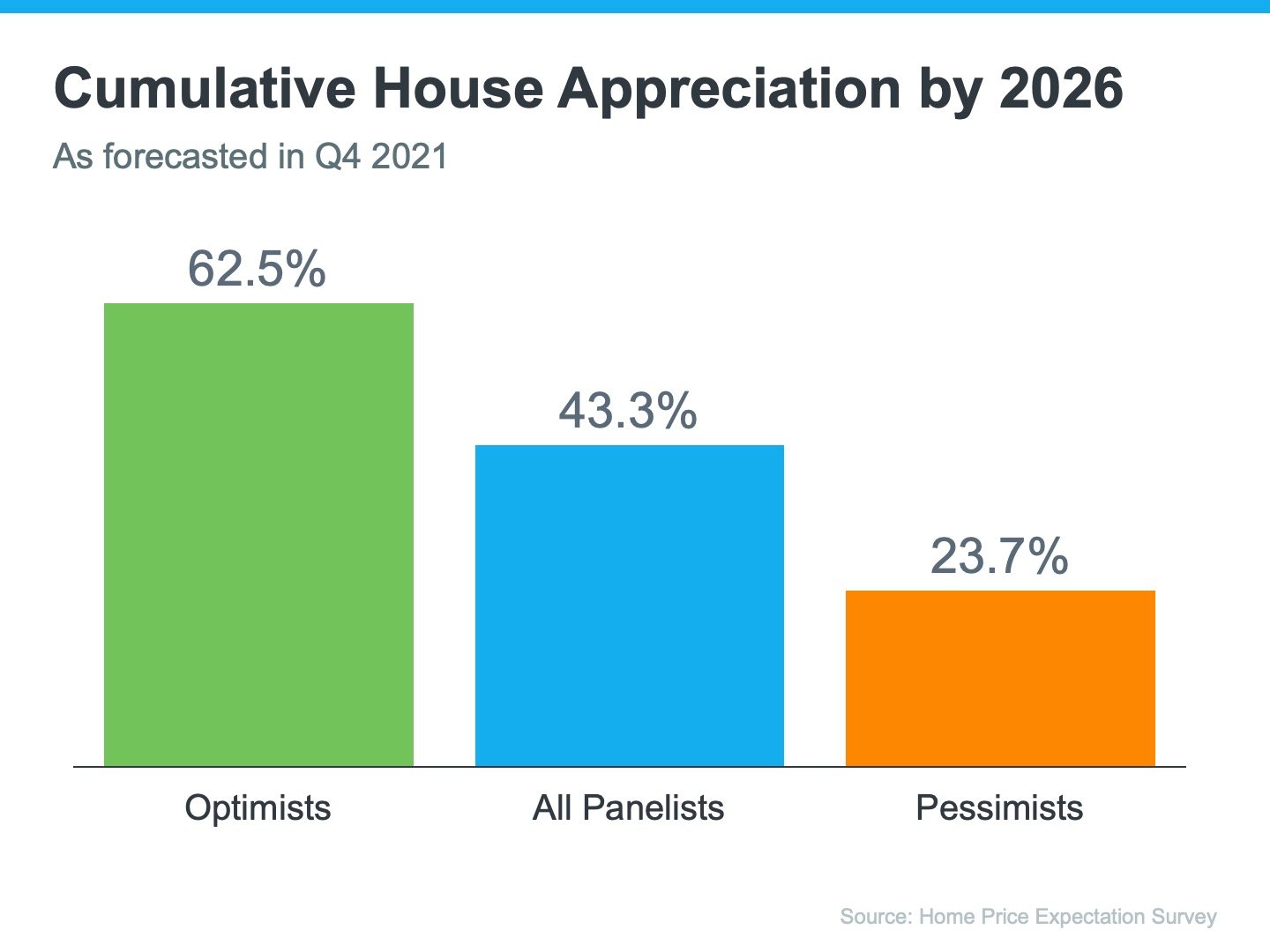

The housing industry experts recently surveyed, even the most pessimistic ones, believe home prices will continue to appreciate through at least 2026;

Bottom Line

The fundamental market conditions we are experiencing now are vastly different than what we experienced in the mid-2000s that led to the previous housing market crash.

Traditionally, rising mortgage rates do not typically have a major impact on housing demand, but do impact the type of homes people are shopping for and will help to moderate home price appreciation.

Depending on how much rates rise, rather the cause someone to not buy a home we typically see them shop at a lower price point. We would also expect to see demand for second homes and investment properties decline, which will also help bring balance back into the market.

Do you have questions or a specific real estate situation you would like to discuss in more detail? If so, please give us a call at 469-296-2530 or email Contact@S2RealEstateTeam.com