Mortgage rates have jumped, the Fed is on bubble watch, and the media is reporting a drop in pending home sales.

Just another month in real estate😀

Mortgage rates are definitely the headline story this month as nobody expected them to rise as quickly as they did. Do rising mortgage rates, coupled with rising home prices, mean the real estate market is heading into rough waters?

As I mentioned last week, I’ve never met anyone whose crystal ball didn’t have some fog in it, and while it’s obvious to everyone the red-hot real estate market cannot continue this run forever, the question is will it cool slowly or come crashing down?

That’s what we’re going to discuss in the month’s real estate market update.

Watch the following video, or continue reading below, to learn more;

A Housing Bubble Emerging?

Without a doubt, there are signs of anxiety in the housing market right now as rising mortgage rates, continued home price appreciation, and crazy high inflation has people feeling uneasy about where the market is heading.

The Federal Reserve Bank in Dallas did little to quell that anxiety by releasing a report recently indicating they were watching for signs of a housing bubble. For clarity, the Fed didn’t say we were in a bubble but said that “overexuberance” caused by a “fear of missing out” could lead to a bubble as market dynamics start operating outside of fundamental norms.

What exactly does that mean?

What the Fed is saying is signs of the market being overheated due to homebuyers rushing into the market out of fear of being priced out were starting to appear. This “fear of missing out” was causing home prices to increase even faster and the resulting market conditions were outside of what would be expected given the current imbalance between supply and demand.

Bottom line. Everyone needs to calm down and not rush into anything out of fear😀

Will Mortgage Rates Keep Rising?

While mortgage rates have risen faster than expected, they are not expected to keep climbing as they have over the past month. The belief is this was more of a knee-jerk reaction of the market factoring in moves the Fed is expected to make later this year.

Here is what Len Kiefer, Deputy Chief Economist at Freddie Mac had to say;

Although it’s logical to think the jump in mortgage rates will cause home prices to fall, historically we haven’t seen that happen in rising mortgage rate environments.

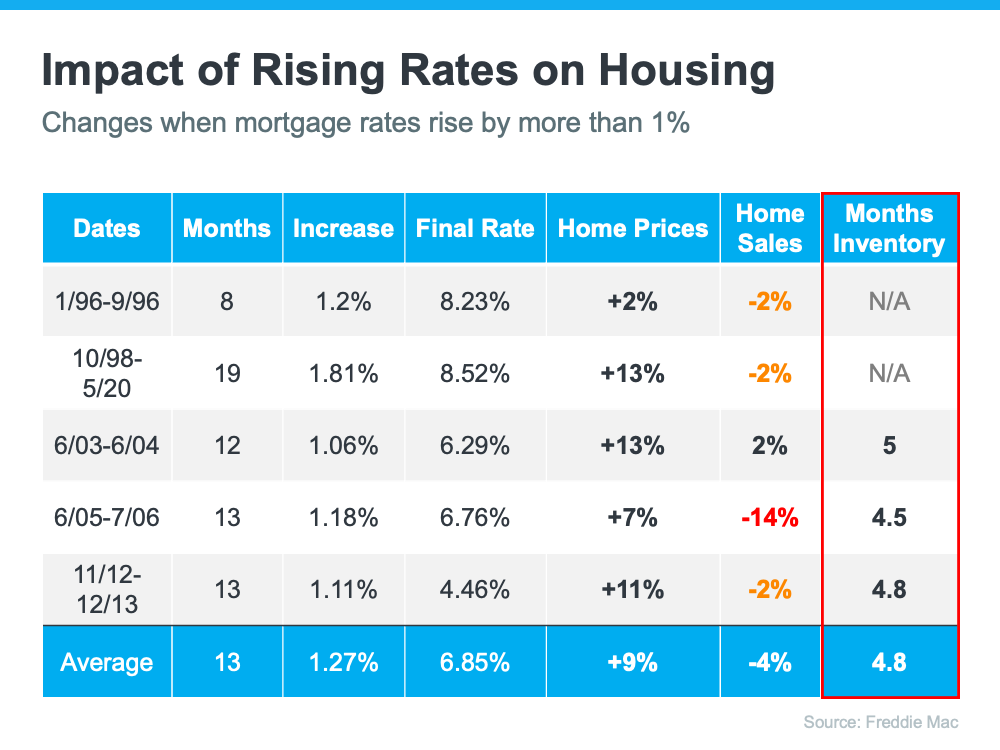

Here is data from Freddie Mac showing what home prices have done previously as mortgage rates rose;

As you can see, home prices in previous rising rate environments have actually risen. It’s the total number of home sales that fell. That makes sense when you consider demand will fall due to some people getting priced out of the market.

There are a couple of other factors we need to consider though. In the years noted above, we weren’t facing the same level of inflation as we are now. When the price of just about everything is rising much faster than wages it’s only a matter of time before affordability becomes a bigger problem. A continued decrease in affordability will result in a softening of demand.

Another difference is in the number of homes for sale. In the years referenced above, there were substantially more homes for sale than there are today. While the average inventory noted above is 4.8 months, there is less than a month's worth of inventory in any of the markets we work in - Frisco, Phoenix, and Temecula, CA.

Are there any Signs of a Slowdown?

One of the challenges with the reports you read or stories you see on the news is the delay in reporting. Here we are in mid-April and the numbers for January and February are just being released.

Altos Research is a company we use for a lot of the data we share and power the market reports that we publish each week.

Altos tracks every home for sale in the country and updates their information each week. As such, signs start to appear in the week-over-week data long before they are reported in the mainstream media.

Here is what Mike Simenson, President of Altos Research, had to say this past week;

Mike’s comment about the market heating up coincides with the Feds’ assertion that rising mortgage rates were causing “overexuberance” and is something we will be keeping our eye on.

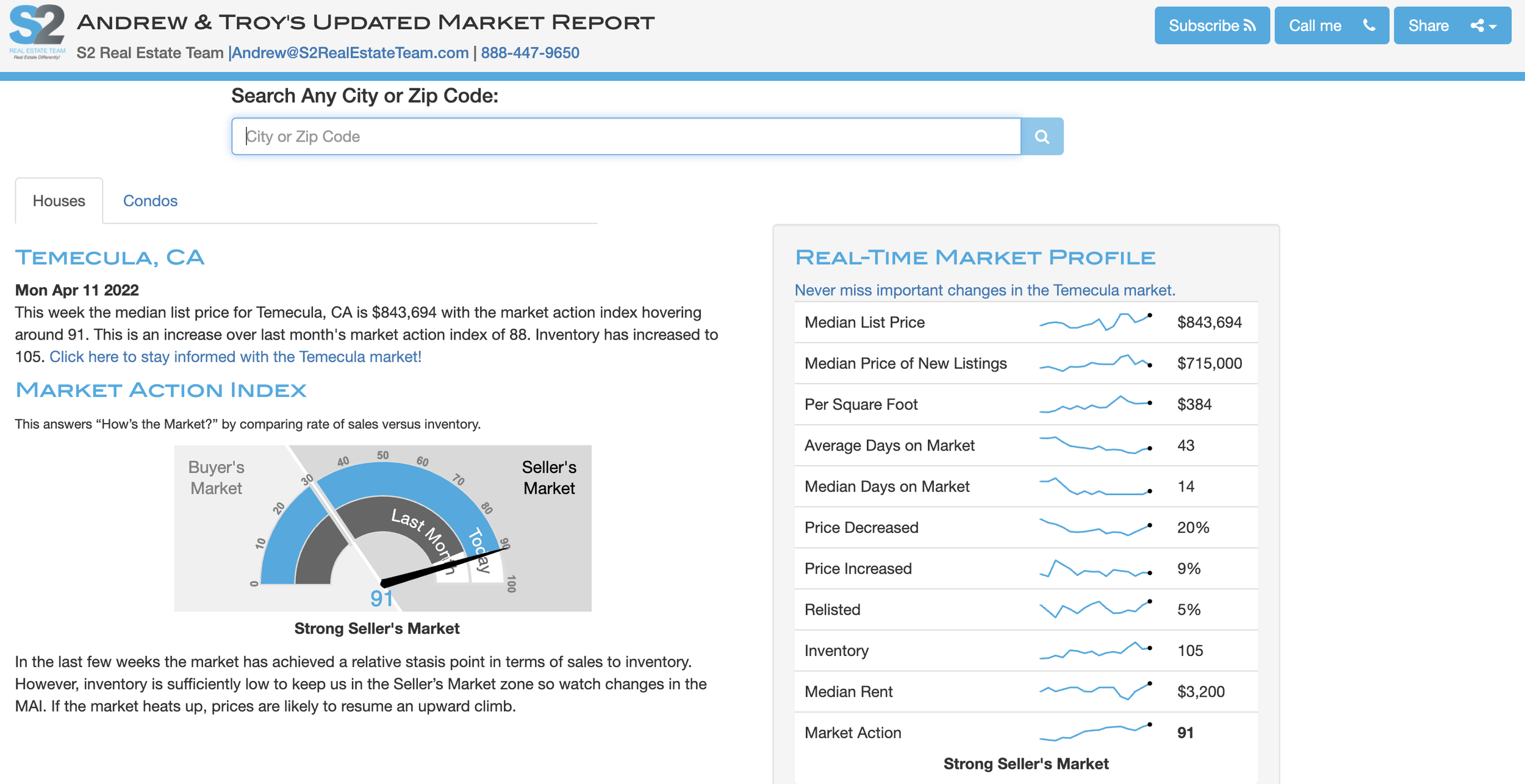

The Altos market reports contain a feature called the Market Action Index. Think of the index as a speedometer that goes from 0 to 100. The higher the number, the hotter the market. Any reading over 30 indicates market conditions favor sellers.

Here’s a snapshot of the Frisco market this week;

Even though we are finally seeing inventory (the number of homes for sale) start to rise, the market remains red hot with a Market Action Index number of 97.

In comparison, here is a look at the Phoenix market;

The Phoenix market saw its Market Action Index increase from a reading of 91 last week to 98 this week, very similar to the number here in Frisco.

Although just slightly lower than Frisco or Phoenix, the Market Action Index in Temecula increased from the previous week as well.

While there haven’t been any signs of a housing market slowdown yet, we do expect to the see impact of rising mortgage rates and inflation appear in the months ahead.

If you’re a potential homebuyer hoping home prices will fall in the months ahead, there are currently no signs that is going to happen.

As the data above shows, as we move into what is traditionally the busiest real estate months of the year, the real estate markets we watch closely are not showing any signs of slowing down.

What About Pending Home Sales

You may have seen reports recently that pending (homes under contract) sales are down. Please don’t take this as a sign the housing market is starting to cool.

Pending home sales are down year-over-year simply because there are fewer homes for sale this year than last year, not because of prices, mortgage rates, or inflation.

Demand has remained high against record low supply.

Home Prices Going Forward

While rising mortgage rates, high inflation, and economic uncertainty each play a role, the future of home prices remains largely dependent on the relationship between supply and demand.

Without a doubt, as mortgage rates rise and the price of everything gets more expensive, homebuyers will have less money available for their mortgage payment and demand will soften. Some buyers will be priced out of the market, while others will have to consider more outlying areas or buying a home smaller than they originally wanted.

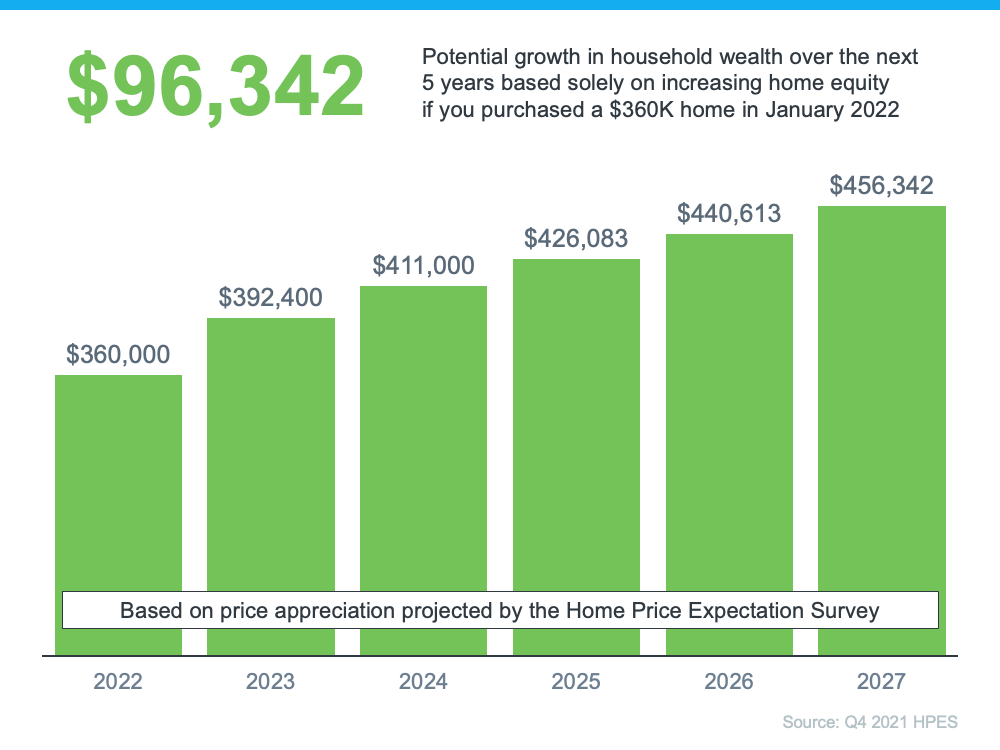

Nevertheless, the latest home price expectation survey shows the experts believe home prices will continue to appreciate, albeit at a slower pace, for the next several years;

How Did We Get Here

Although it feels like this crazy real estate market appeared out of nowhere, it has actually been years in the making.

New home construction has simply not kept up with the pace of new household creation and has coincided with Millenials, the largest generation, reaching their prime homebuying age.

New home builders were hit very hard by the housing market crash in 2008 and have been very slow to recover.

Here is a look at annual new home construction in the United States going back to 1970;

Real estate supply comes from one of two places, resale homes or new construction.

Following the pandemic lockdowns, homeowners were reluctant to put their homes on the market out of fear of having potentially infected strangers walking through their homes. As resale inventory dwindled, buyers turned their attention to new construction. As you can see above, annual new home construction has been below historical norms for the past 14 years. It didn’t take long for the supply of new homes to be exhausted.

As homeowners became comfortable with the idea of listing their homes for sale again, they suddenly found there was nothing to buy. Not wanting to end up with nowhere to live, they chose to wait and not list their homes for sale. Add in pandemic-related supply issues extending the amount of time it takes to build new homes and here we are.

Light at the end of the Tunnel

There appears to be a tremendous amount of pent-up seller demand (sellers who want to sell). A recent survey by Realtor.com found that two-thirds of homeowners believed this was a good time to sell. Of those that planned on selling this year, 64% planned on listing their home for sale by August.

On the flip side, a recent survey of consumers by Fannie Mae found that only 24% of those surveyed believed now was a good time to buy.

Seller confidence is up, while buyer confidence is down. While I don’t believe this is enough to cause a dramatic downturn in the housing market, I do believe we will see more balance, fewer multiple offers, more homes for sale, an end to waitlists at every new construction community. In other words, we should start to see a more normal market, which would be welcomed by all of us.

Have additional questions? We’d be happy to talk to you. Give us a call at 469-296-5230 or email Contact@S2RealEstateTeam.com