We all knew it would happen……

We knew that change was on the horizon…..

While there are still no signs of a crash, and we don’t fit the definition of a bubble, the housing market is in the midst of a shift.

What’s the difference?

A crash is what happened in 2008, a bubble is a rapid run-up in prices caused by over-exuberance and speculation, not a major imbalance between supply and demand (like we’ve had). No matter what you call it, the housing market is changing.

For the past few weeks, we’ve been seeing signs of the housing market slowing down, cooling if you will. Not surprising considering we’ve been running foot to the floor for just about 2 years now.

Continue reading below, or watch the following video, to learn more about the changes we are starting to see and how they will impact you if considering buying or selling a home.

A Housing Market Shift

A housing market shift simply means that conditions within the housing market are starting to change.

There certainly isn’t a shortage of opinions out there about what the next 6 to 12 months are going to look like, but I guarantee they are all just opinions, because nobody knows for sure, not even the experts.

Some of these opinions are based are what has happened historically, some are based on gut feelings, some are based on the data, and some are based on absolutely nothing at all.

I’m certainly not going to pretend to have all the answers, but what I do have is access to a lot of information and data, as well as 20 years of experience. My goal here is simply to share the information and provide some perspective, so you can make the best decision for your particular situation.

For Home Buyers

To buy or not to buy, that is the question.

I know a couple who sold their home two years ago and rented because they believed the market was about to crash. In hindsight, not the best idea, but they believed it was the best idea for them at the time.

I remember the author Andy Andrews saying “you are where you are as a result of your own best thinking.” After all, nobody intentionally sets out to make a bad decision.

Mortgage Rates

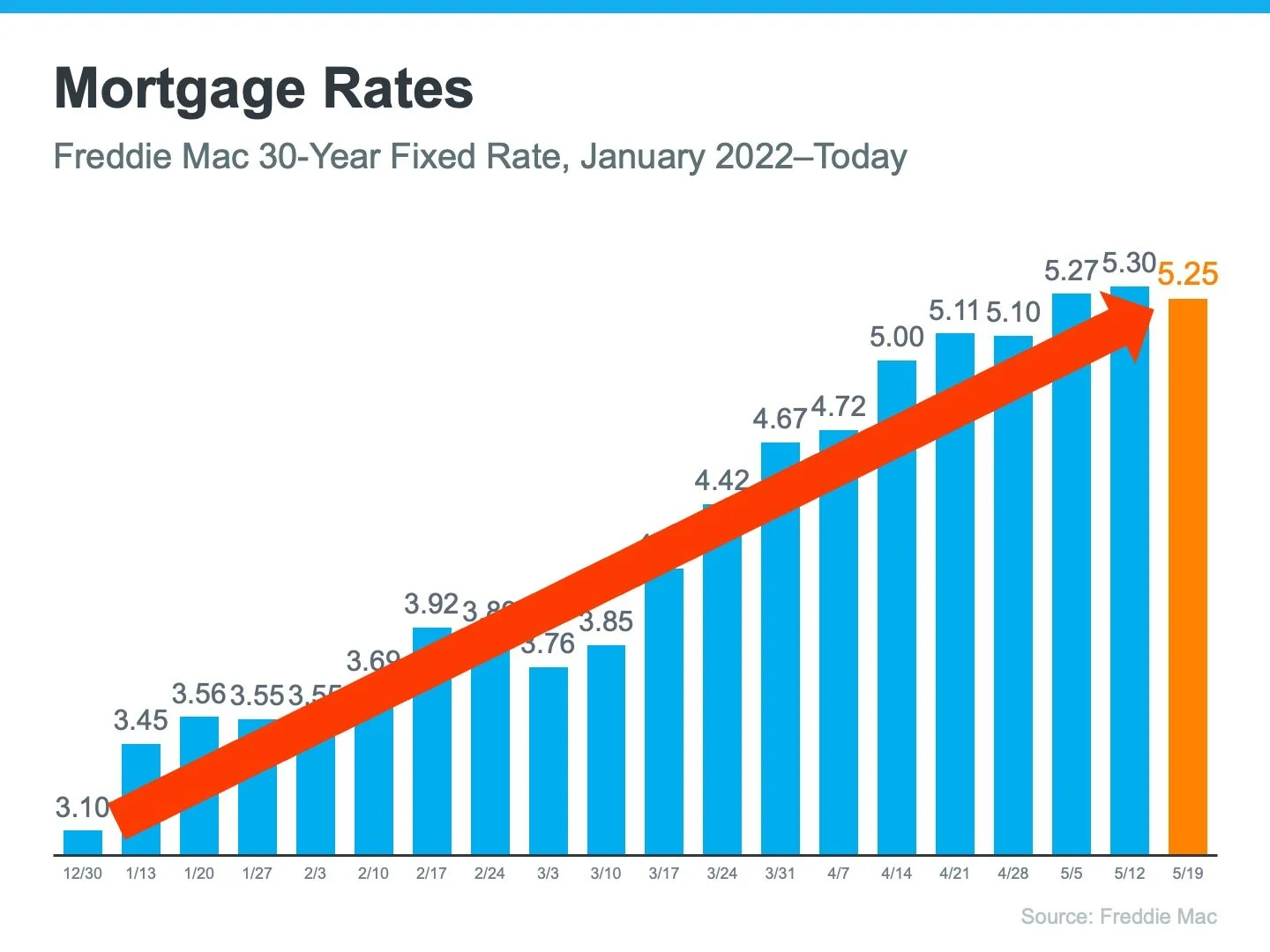

At the beginning of this year, mortgage rates were 3.1% and now sit at 5.25%. That’s a massive increase that nobody forecast. While the experts thought rates would rise in 2022, the consensus belief was they would end the year between 3.75% and 4%.

The rapid rise in mortgage rates caused some buyers to get priced out of the market while others have chosen to take a step back and see how everything plays out.

A 1% increase in mortgage rates decreases a buyer’s purchasing ability by approximately 10%. As such, buyers have found they can now afford 20% less home than they were pre-approved for just a few months ago. A very difficult position to be in while home prices have continued to rise.

Some good news is Freddie Mac believes the pace of mortgage rates increases will moderate going forward.

There are some that have speculated the rapid rise in mortgage rates alone would send the housing market crashing down, but that is unlikely to be the case.

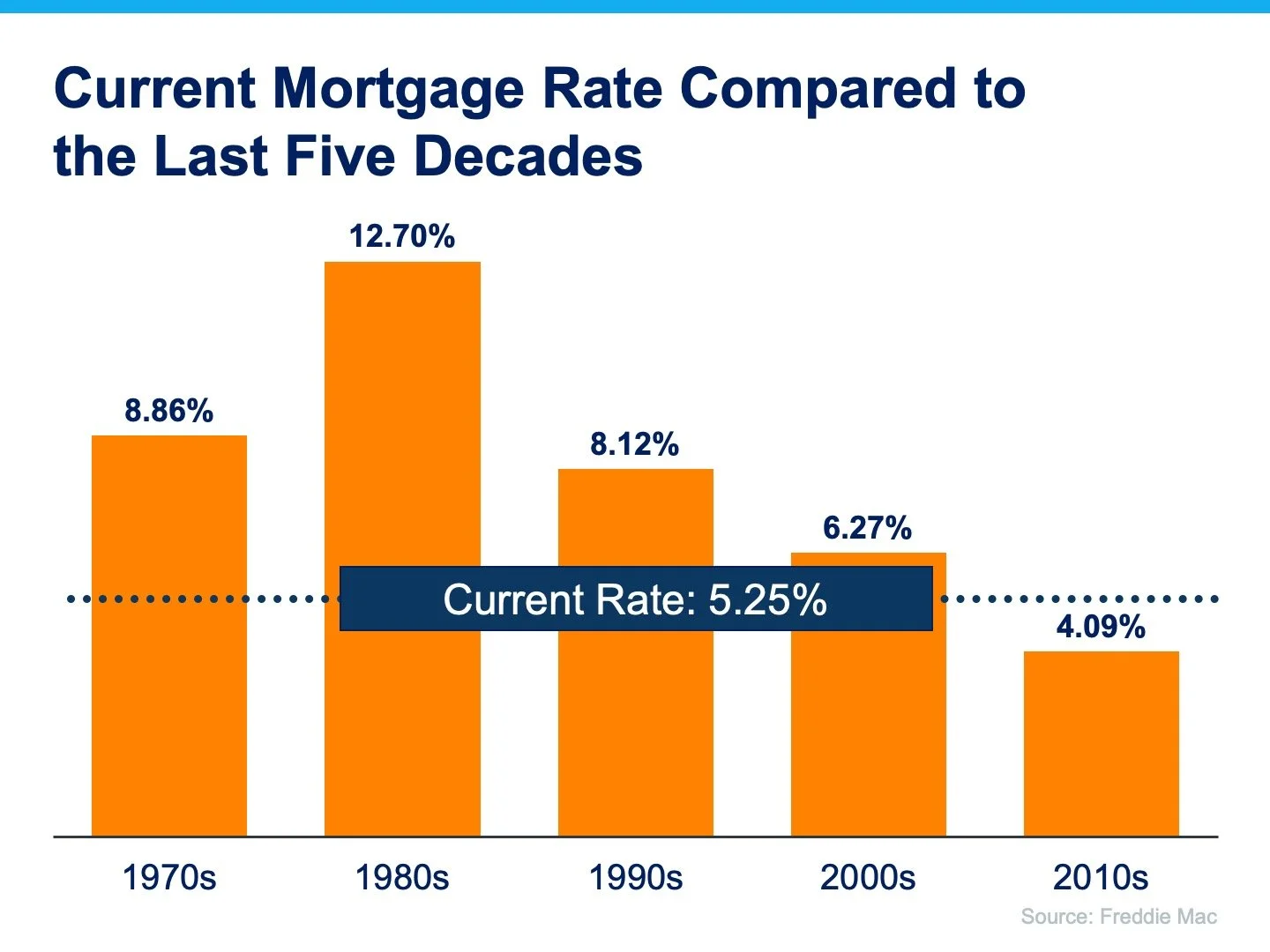

For many potential buyers, mortgage rates have risen into uncharted territory. When you consider rates that have stayed below 4% for much of the past decade many buyers are unaware of anything different, but historically rates are still considered low, not that it matters to those in the market to buy a home now.

The Future of Mortgage Rates

Inflation is another factor impacting the housing market right now. Whether you rent or buy, housing costs, along with everything else, are going up. The main weapon in the Federal Reserve’s arsenal to combat inflation is interest rates. The Fed has made no secret of the fact they intend to raise interest rates aggressively to combat inflation.

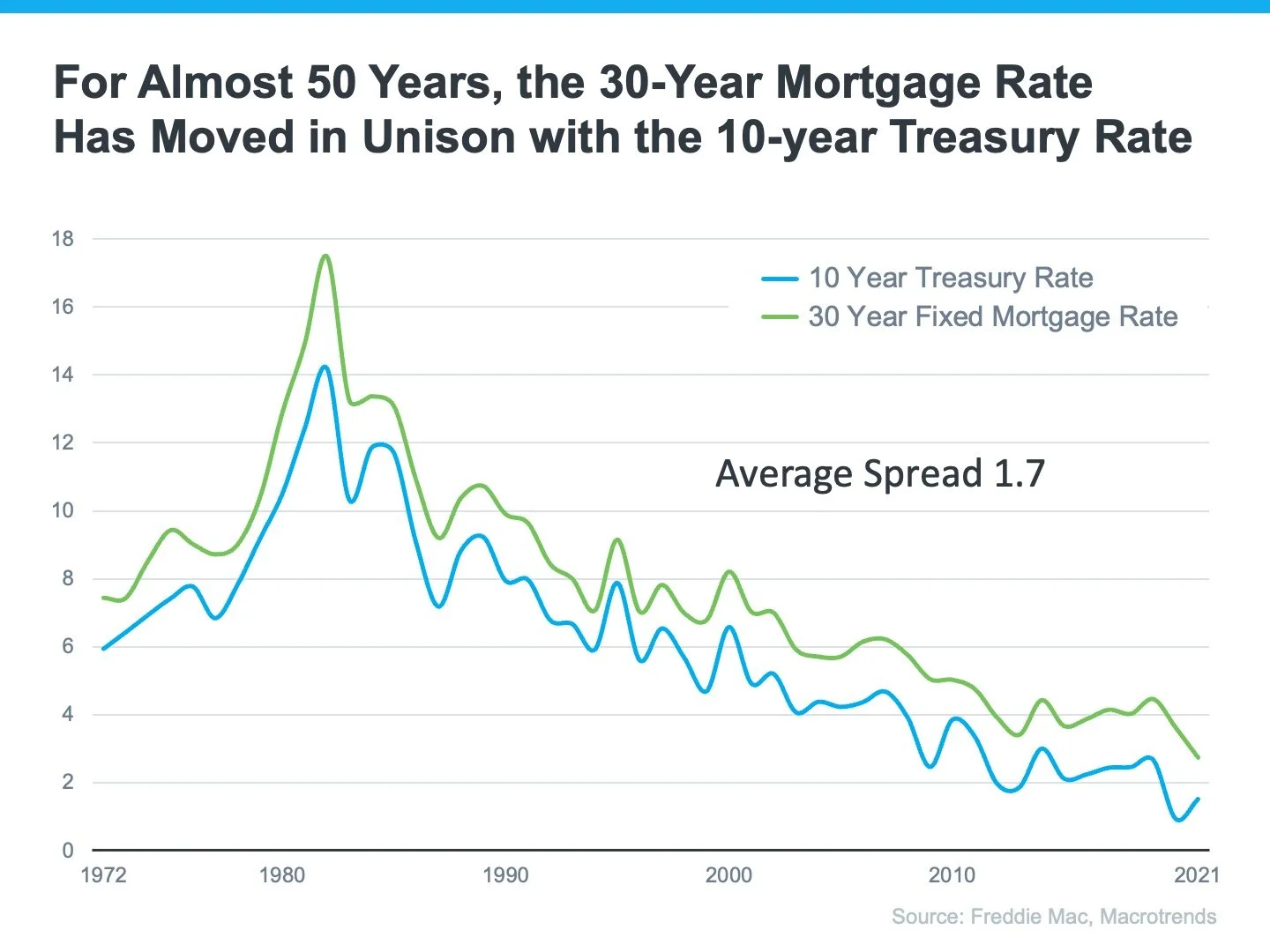

While this will make credit cards, car loans, personal loans, and home equity lines of credit more expensive, it does not directly impact 30-year mortgage rates.

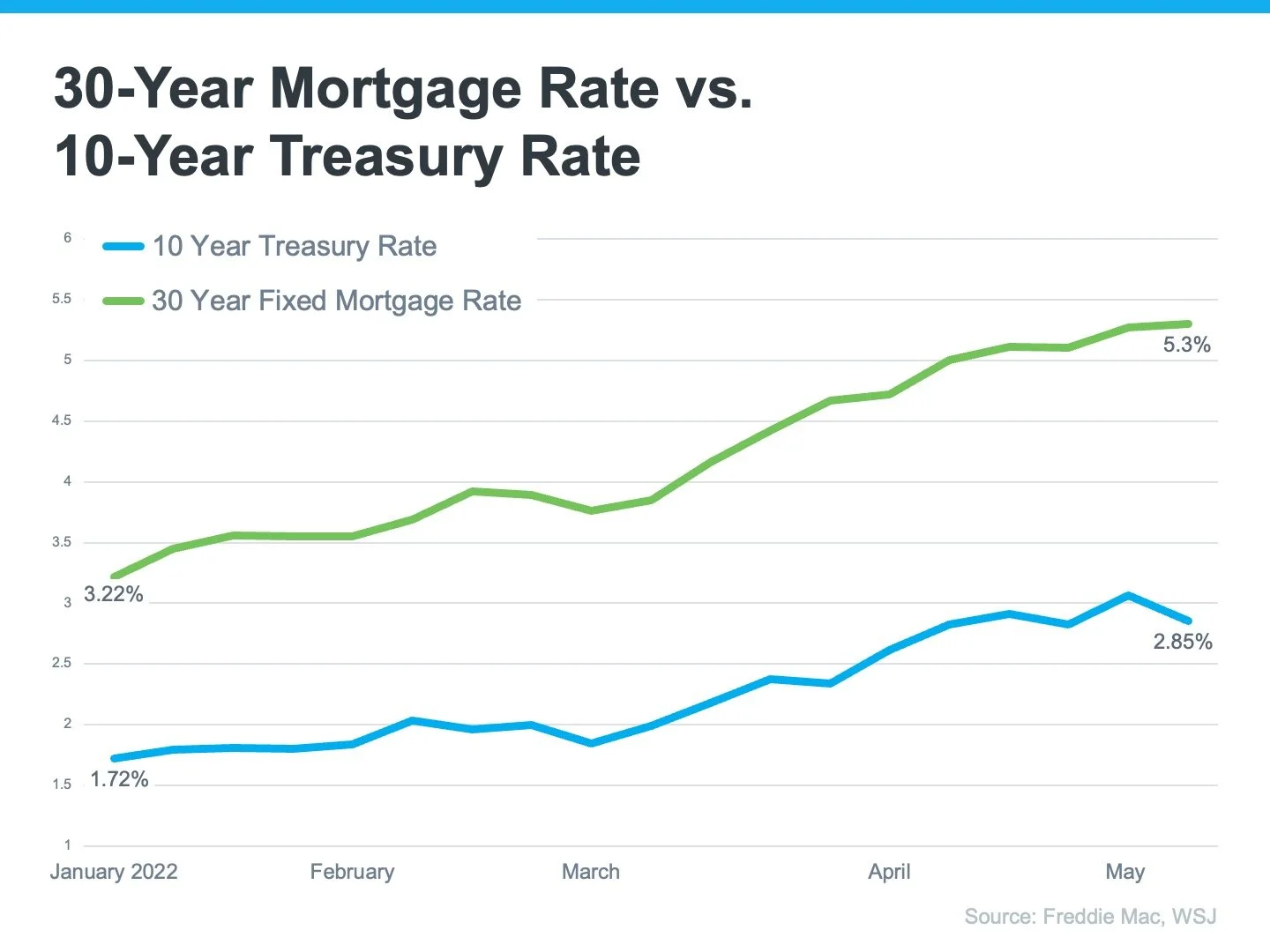

30-year mortgage rates are closely tied to the yield on the 10-Year Treasury Bond.

To gauge where 30-year mortgage rates are heading your best bet is to keep an eye on the 10-Year Treasury Rate.

Here is how that rate has been trending this year.

A Bad Time to Buy a Home

As mortgage rates have risen, it should come as no surprise that home-buyer sentiment has fallen.

The latest surveys show the number of potential buyers that think now is a good time to buy is the lowest it has been in the past couple of years.

Even though home prices and mortgage rates have dominated the headlines, it’s important to keep in mind the decision to buy, or sell, a home is usually made due to a change in life circumstances, getting married, growing family, job transfer, empty nester, etc. than current market conditions. It becomes a matter of looking for the best opportunity available at the time you need to make a move.

Going Forward

This past week, the supply of homes nationally rose 8%, which is the largest jump in inventory we have seen in quite some time and marked the second consecutive week of year-over-year inventory gains.

Even though that’s positive news, 24% of all new listings went under contract within a week, which shows there is still a tremendous amount of demand. Home prices also reached a new record high, but I expect the pace of appreciation to flatten as supply rises and demand declines.

Overall, buyers should expect to start seeing more choices, fewer multiple offers, and fewer bidding wars.

How much of a change, and how fast it changes, will depend on where you live as some markets will be impacted more than others.

For Sellers

Any cooling in the market will honestly feel like somebody slammed on the brakes. Sellers who saw lines of people and jam-packed open houses a few weeks ago will wonder what’s going on when activity isn’t as robust when they put their house up for sale.

When you’ve been cruising down the highway at 100 mph and take your foot off the gas, 80 mph suddenly feels like a crawl, even though you're still moving quite fast.

You haven’t missed the boat, prices are not declining, and homes are still selling rapidly.

Saying that you will start to notice a lot more price reductions. Those don’t mean prices are falling, but sellers who priced their home ahead of the market thinking it would catch up within a week are going to find they have to reduce the list price in order to generate an offer.

Normally, about 33% of listed homes receive a price reduction before going under contract. Here in Frisco, that number was only 5% in January, but has climbed to 21% today, more than we have seen recently, but still less than we see under normal conditions.

Don’t be surprised when your home doesn’t go under contract the first weekend and you only end up receiving 5 offers instead of 15 to 20.

That being said, homes are still selling above list price, once priced correctly, but I do expect the sale to list price percentage to decline over the coming months.

How Much Equity Have You Gained in Your Home? CLICK HERE to Find Out Instantly and Receive a Monthly Update

One of the biggest challenges sellers have faced is how to time the sale and purchase in this crazy market so they don’t end up having to make a double move or live with family or friends until their new home is ready. If that’s you, our preferred lending partner has a buy now/sell later program that allows you to secure your replacement home before listing your current home for sale. Contact Us if you’d like more information about this program.

Bottom Line

A cooling market doesn’t mean a crashing market. Only you can make the decision that’s best for you and your family, but hopefully, the information we provide here helps provide you with the facts, data, and insights you need to make that decision.