It seems that for months now we’ve been waiting for the proverbial shoe to drop in the housing market.

Despite forecasts of crashing prices, rising foreclosures, and no buyers due to high mortgage rates, the housing market remains resilient and there are still no signs anywhere in the data to indicate trouble in the months ahead, even with increasing talk of a recession.

In this real estate market update for May, I’m going to share the latest information on home prices, talk about inventory and the impact it’s having on home prices, what a recession would mean for the housing market, then close out by taking a closer look at the latest numbers for Frisco and Prosper.

Watch the following video, or continue reading below, to learn more;

Home Prices

Not that long ago, it seems that headlines about home price declines were everywhere. Last fall, the real estate market virtually ground to a halt on the back of mortgage rates that surpassed 7%. The slowdown in activity led many experts to predict that home prices in 2023 would fall by up to 25%.

Home prices did fall and continued to fall in many markets as we started 2023 but by March prices actually started rising again as noted by Andy Walden, VP of Enterprise Research, Black Knight;

The change has been so pronounced that many forecasters are starting to revise their projections for home prices in 2023 upwards. Here’s how Fannie Mae revised their forecast from March to April;

Inventory

So why aren’t the projected home price declines taking place?

A lack of inventory.

Although rising mortgage rates caused the total number of buyers to decline, there still isn’t enough inventory to satisfy the demands of those buyers still in the market, especially here in Frisco and Prosper.

As a result, depending on where you live, prices are mainly holding steady, or increasing slightly.

Considering the majority of outstanding mortgages are below 4%, homeowners are unwilling to trade in that low mortgage for a new one at 6.5%. Many are simply choosing not to sell, or are taking equity out of their current home to buy a new one and turning the existing property into a cash-flowing rental.

What About Foreclosures?

Ever since the onset of the pandemic, we’ve been hearing about a wave of foreclosures in the pipeline. The latest headlines talking about the increase in foreclosure filings might have you thinking that the wave is getting closer.

Here are a few of the recent headlines about foreclosure activity;

Although the headlines are factually correct, they aren’t telling the whole story.

Foreclosures are a part of every real estate market, good and bad. With that in mind, here’s a graph that shows annual foreclosure activity since 2005 for some perspective on where we stand today;

Although foreclosure activity is up, the number of foreclosure repossessions is near historical lows due to how equity rich the vast majority of homeowners are. Nearly 68% of all homeowners have a minimum of 50% equity.

This means even if someone found themselves in financial difficulty and couldn’t afford to keep the home, rather than be foreclosed on, the home could be sold traditionally to satisfy the mortgage and provide the homeowner with money to move on.

The Impact of a Recession

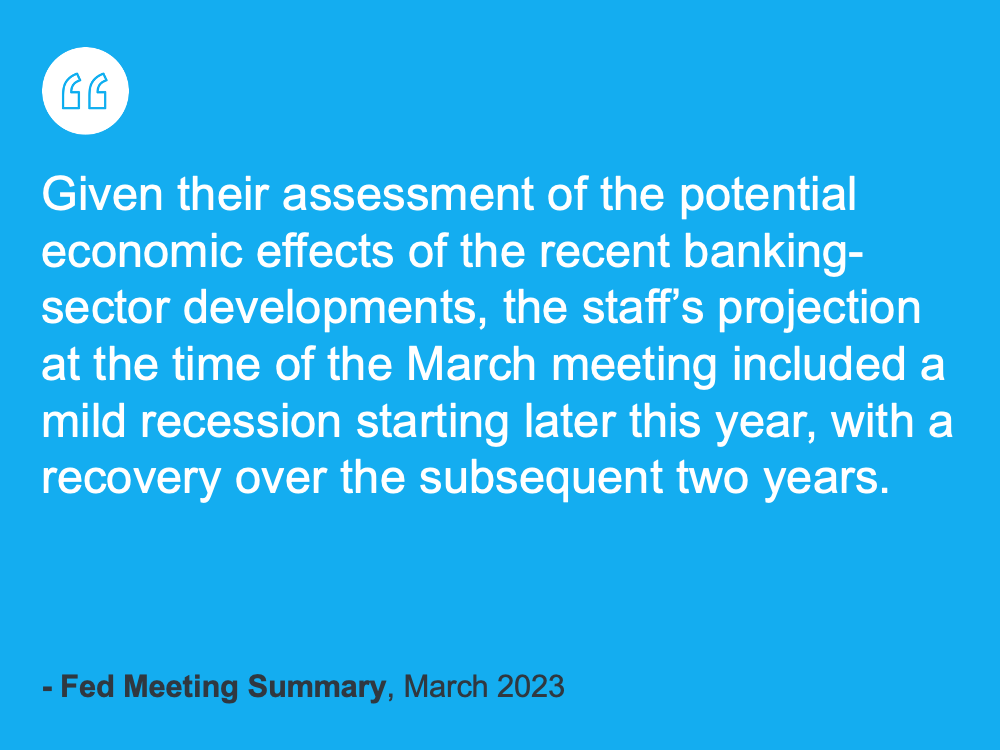

While speculation about a recession has been with us for the past several months, the Fed acknowledged at their last meeting that a mild recession is likely to happen later this year;

Assuming that a recession does happen, what is the impact on the housing market likely to be?

While you may think that a recession would cause home prices to fall, history shows us that isn’t likely. In 4 of the past 6 recessions, home prices have actually increased.

The exception being a small decline in prices in 1991 and the large drop in prices we experienced during the housing crash of 2008, which is what most people remember.

The truth about recessions is that the housing market is what usually helps the country climb out of the recession. One of the reasons for this is that mortgage rates typically fall during recessions to help encourage economic activity. Those falling mortgage rates increase buyer demand.

Here is how much mortgage rates declined during past recessions;

Frisco Housing Market

While many buyers are still hoping to see price declines here in Frisco, the truth is our home price declines occurred between May and August last year. The median home price fell 18% as mortgage rates rose. After stabilizing in September and October, home prices rebounded in November and December and the overall pricing trend has been relatively stable since then.

While closed sales show us where prices have been, looking at the median price of current listings, along with the percentage of homes taking a price reduction before going under contract, shows us where prices are heading.

You can see on this graph that prices were fairly stable to start the year before trending upwards over the last few weeks;

While list prices don’t tell us exactly where the sales price will be, when you factor in the percentage of homes taking a price reduction before going under contract you get a good idea of overall demand. When demand is higher, sells don’t need to reduce the list price in order to receive an offer;

From this graph, you can see that pre-pandemic it was normal for the percentage of homes reducing price before going under contract to be between 40% and 60%. After peaking at just over 60% last fall, the number of homes taking a price reduction now has been falling and currently sits at 30%.

The reason for this is a lack of inventory. There are simply not enough homes for sale to satisfy demand. Normally, we would see inventory build through the busy spring season, but this year we saw inventory continue to fall into March;

As a result, we are continuing to see homes in all price segments sell relatively quickly and it’s not uncommon for new listings to receive multiple offers. We aren’t seeing the crazy bidding wars of early last year, but the Frisco real estate market remains active.

Here is a link to the full Frisco Market Report.

Prosper Housing Market

Like Frisco, home prices in Propser also experienced declines in the second half of 2022 with the bulk of Propser’s price declines taking between May and December, falling a total of 21%.

Unlike Frisco, the median list price in Prosper has been increasing since the beginning of 2023 and just started to flatten over the past couple of weeks.

Prices have started to flatten as Prosper has followed a more normal inventory curve for this area. Inventory has been growing for most of the year and currently sits at 218 active listings compared to Frisco’s 200. That’s a considerable difference when you factor in the difference in size between Frisco and Prosper.

Like in Frisco, the percentage of homes needing a price reduction before going under contract has been falling for much of this year. After peaking at 61% in November, price reductions reached a low of 29% in late March before climbing to 31%. The slight increase in price reductions coincides with the flattening of list prices.

Here is a link to the complete Prosper Market Report.

Bottom Line

While there is some uncertainty about what is going to happen with the economy, the fundamentals of the housing market, especially here in Frisco and Prosper, remain strong. The leading indicators we just looked at tell us we shouldn’t be expecting any major changes this year.

Year-over-year pricing comparisons will start to read positive in the next couple of months but don’t take that as an indication prices are rising, rather, prices this year are holding steady while they were falling last year giving the appearance of increasing prices.

If you have questions about the market or want to know if this is a good time for you to consider buying or selling a home, schedule a call, and let’s talk about it.